Time Warner Cable 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

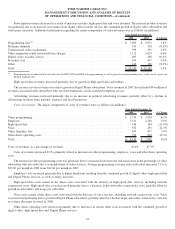

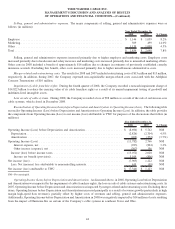

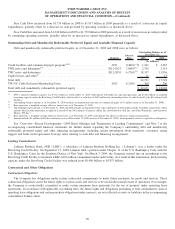

TWC incurs expenditures associated with the construction of its cable systems. Costs associated with the construction of transmission and

distribution facilities are capitalized. TWC generally capitalizes expenditures for tangible fixed assets having a useful life of greater than one year.

Capitalized costs include direct material, labor and overhead, as well as interest. Sales and marketing costs, as well as the costs of repairing or

maintaining existing fixed assets, are expensed as incurred. With respect to customer premise equipment, which includes set-top boxes and

high-speed data and telephone modems, TWC capitalizes installation costs only upon the initial deployment of these assets. All costs incurred in

subsequent disconnects and reconnects of previously installed customer premise equipment are expensed as incurred. Depreciation on these assets

is provided generally using the straight-line method over their estimated useful lives. For set-top boxes and modems, the useful life is 3 to 5 years,

and, for distribution plant, the useful life is up to 16 years.

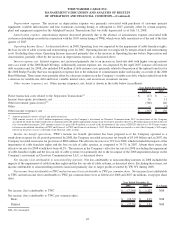

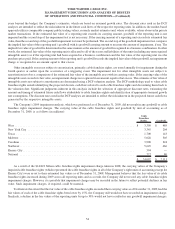

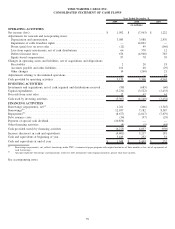

Financing Activities

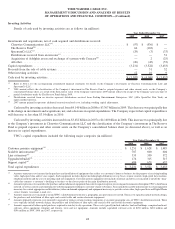

Details of cash provided (used) by financing activities are as follows (in millions):

2009 2008 2007

Year Ended December 31,

Borrowings (repayments), net

(a)

................................................ $ 1,261 $ (206) $(1,545)

Borrowings ............................................................... 12,037 7,182 8,387

Repayments .............................................................. (8,677) (2,817) (7,679)

Debt issuance costs ......................................................... (34) (97) (29)

Payment of Special Dividend.................................................. (10,856) — —

Other financing activities. . . .................................................. (4) (5) (84)

Cash provided (used) by financing activities ...................................... $ (6,273) $ 4,057 $ (950)

(a)

Borrowings (repayments), net, reflects borrowings under the Company’s commercial paper program with original maturities of three months or less, net of

repayments of such borrowings.

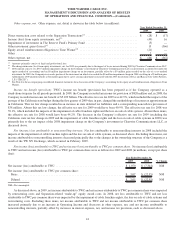

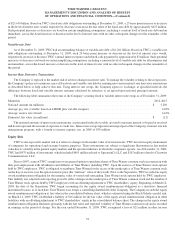

Cash provided by financing activities was $4.057 billion in 2008 compared to cash used by financing activities of $6.273 billion in

2009. Cash used by financing activities in 2009 primarily included the payment of the Special Dividend, partially offset by the net

proceeds of the 2009 Bond Offerings (after repayment of other debt). Cash provided by financing activities in 2008 primarily included the

net proceeds from the 2008 Bond Offerings, partially offset by repayments under the Revolving Credit Facility and commercial paper

program, the repayment of TWE’s 7.25% debentures due September 1, 2008 (aggregate principal amount of $600 million), and debt

issuance costs relating to the 2008 Bond Offerings and the 2008 Bridge Facility.

Cash used by financing activities was $950 million in 2007 compared to cash provided by financing activities of $4.057 billion in

2008. Cash provided by financing activities in 2008 primarily included the net proceeds from the 2008 Bond Offerings, partially offset by

repayments under the Revolving Credit Facility and commercial paper program, the repayment of TWE’s matured long-term debt

(discussed above), and debt issuance costs relating to the 2008 Bond Offerings and the 2008 Bridge Facility. Cash used by financing

activities for 2007 included net repayments under the Company’s debt obligations and payments for other financing activities.

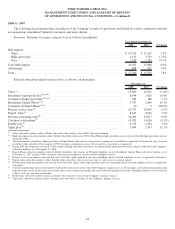

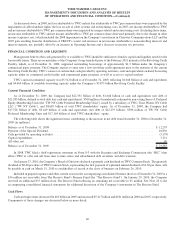

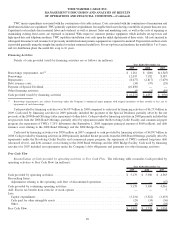

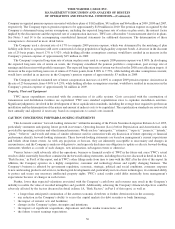

Free Cash Flow

Reconciliation of Cash provided by operating activities to Free Cash Flow. The following table reconciles Cash provided by

operating activities to Free Cash Flow (in millions):

2009 2008 2007

Year Ended December 31,

Cash provided by operating activities ............................................ $ 5,179 $ 5,300 $ 4,563

Reconciling Items:

Adjustments relating to the operating cash flow of discontinued operations .............. — — (47)

Cash provided by continuing operating activities ................................... 5,179 5,300 4,516

Add: Excess tax benefit from exercise of stock options .............................. — — 5

Less:

Capital expenditures ...................................................... (3,231) (3,522) (3,433)

Cash paid for other intangible assets .......................................... (25) (34) (36)

Other ................................................................. (6) (5) (28)

Free Cash Flow............................................................ $ 1,917 $ 1,739 $ 1,024

49

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)