Time Warner Cable 2009 Annual Report Download - page 45

Download and view the complete annual report

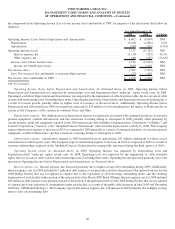

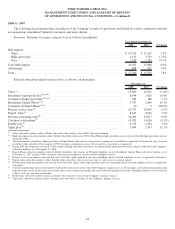

Please find page 45 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.penetration levels, competition, regulation, pricing and the state of the economy. Video programming costs represent a major component

of TWC’s expenses and are expected to continue to increase, reflecting rate increases on existing programming services, costs associated

with retransmission consent agreements, growth in video subscribers taking tiers of service with more channels and the expansion of

service offerings (e.g., new network channels). TWC expects that its video programming costs as a percentage of video revenues will

continue to increase as increases in programming costs outpace growth in video revenues. TWC also offers video services to business

customers and of the Company’s 12.9 million video subscribers as of December 31, 2009, 160,000 were commercial video subscribers.

As of December 31, 2009, TWC had approximately 9.0 million residential high-speed data subscribers. TWC expects continued

growth in residential high-speed data subscribers and revenues for the foreseeable future; however, future high-speed data subscriber and

revenue growth rates will depend on high-speed data penetration levels, competition, regulation, pricing, the rate of wireless substitution

of wireline high-speed data service and the state of the economy. TWC also offers high-speed data services to business customers, as well

as networking and transport services, and had 295,000 commercial high-speed data subscribers as of December 31, 2009.

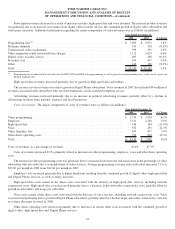

During the fourth quarter of 2009, TWC launched Road Runner Mobile

TM

, a wireless mobile broadband service, in several cities and

expects to continue the roll-out during 2010. The Company estimates that it will incur “start up” losses of approximately $50 million

during 2010 in connection with the deployment of this service.

As of December 31, 2009, TWC had approximately 4.2 million residential Digital Phone subscribers. TWC expects increases in

Digital Phone subscribers and revenues for the foreseeable future; however, future Digital Phone subscriber and revenue growth rates will

depend on Digital Phone penetration levels, competition, regulation, pricing, the rate of wireless substitution of wireline phone service

and the state of the economy. TWC also offers its commercial Digital Phone service, Business Class Phone, in nearly all of its operating

areas and had 67,000 commercial Digital Phone subscribers as of December 31, 2009.

TWC faces intense competition for customers from a variety of alternative communications, information and entertainment delivery

sources. TWC competes with incumbent local telephone companies, including AT&T Inc. and Verizon Communications Inc., across

each of its primary services. Some of these telephone companies offer a broad range of services with features and functions comparable to

those provided by TWC and in bundles similar to those offered by TWC, sometimes with the addition of wireless service. Each of TWC’s

services also faces competition from other companies that provide services on a stand-alone basis. TWC’s video service faces

competition from direct broadcast satellite services, and increasingly from companies that deliver content to consumers over the Internet.

TWC’s high-speed data service faces competition from wireless data providers, and competition in voice service is increasing as more

homes in the U.S. are replacing their wireline telephone service with wireless service. Technological advances and product innovations

have increased and will likely continue to increase the number of alternatives available to TWC’s customers, further intensifying

competition. The more competitive environment may negatively affect the growth of primary service units and average monthly

subscription revenues per primary service unit and, additionally, may increase TWC’s cost to obtain certain video programming.

Since the fourth quarter of 2008, the Company has experienced a slowdown in growth across all primary service unit categories,

which the Company believes is in significant part a result of a challenging economic environment. In particular, the Company believes its

subscriber growth has been negatively affected by the slowdown in new home formation and high housing vacancy rates, as well as high

unemployment and the related reduction in consumer spending.

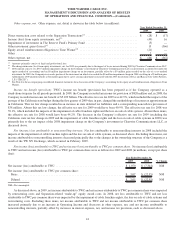

Management believes that cash generated by or available to TWC should be sufficient to fund its capital and liquidity needs for the

foreseeable future. As of December 31, 2009, the Company had approximately $5.5 billion of unused committed capacity (including cash

and equivalents). Additionally, there are no maturities of the Company’s long-term debt prior to the February 2011 maturity of the

Company’s $5.875 billion senior unsecured five-year revolving credit facility (the “Revolving Credit Facility”), which, as of

December 31, 2009, supported outstanding borrowings of approximately $1.3 billion under the Company’s commercial paper

program. The Company expects to enter into a new revolving credit agreement prior to the maturity of the current Revolving

Credit Facility. See “Financial Condition and Liquidity” for further details regarding the Company’s committed capacity.

Recent Developments

Separation from Time Warner, Recapitalization and TWC Reverse Stock Split

On March 12, 2009, TWC’s separation from Time Warner was completed pursuant to a Separation Agreement dated as of May 20,

2008 (the “Separation Agreement”) between TWC and Time Warner and certain of their subsidiaries. In accordance with the Separation

Agreement, on February 25, 2009, a subsidiary of Time Warner transferred its 12.43% non-voting common stock interest in TW NY to

TWC in exchange for 80 million newly issued shares (approximately 27 million shares after giving effect to the 1-for-3 reverse stock split

discussed below) of TWC’s Class A common stock (the “TW NY Exchange”). On March 12, 2009, TWC paid a special cash dividend of

$10.27 per share ($30.81 per share after giving effect to the 1-for-3 reverse stock split, aggregating $10.856 billion) to holders of record on

33

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)