Time Warner Cable 2009 Annual Report Download - page 77

Download and view the complete annual report

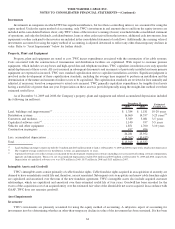

Please find page 77 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.determined that an investment has sustained an other-than-temporary decline in its value, the investment is written down to its fair value

by a charge to earnings. This evaluation is dependent on the specific facts and circumstances. TWC evaluates available information (e.g.,

budgets, business plans, financial statements, etc.) in addition to quoted market prices, if any, in determining whether an

other-than-temporary decline in value exists. Factors indicative of an other-than-temporary decline include recurring operating

losses, credit defaults and subsequent rounds of financing at an amount below the cost basis of the Company’s investment. This list

is not all-inclusive and the Company weighs all known quantitative and qualitative factors in determining if an other-than-temporary

decline in the value of an investment has occurred. In 2009 and 2007, there were no significant investment impairment charges. In 2008,

the Company recorded a noncash pretax impairment charge of $367 million on its investment in Clearwire Communications LLC. Refer

to Note 11 for further details regarding the Company’s investments.

Long-lived Assets

Long-lived assets (e.g., property, plant and equipment) do not require that an annual impairment test be performed; instead, long-

lived assets are tested for impairment upon the occurrence of a triggering event. Triggering events include the more likely than not

disposal of a portion of such assets or the occurrence of an adverse change in the market involving the business employing the related

assets. Once a triggering event has occurred, the impairment test is based on whether the intent is to hold the asset for continued use or to

hold the asset for sale. If the intent is to hold the asset for continued use, the impairment test first requires a comparison of estimated

undiscounted future cash flows generated by the asset group against the carrying value of the asset group. If the carrying value of the asset

group exceeds the estimated undiscounted future cash flows, the asset would be deemed to be impaired. The impairment charge would

then be measured as the difference between the estimated fair value of the asset and its carrying value. Fair value is generally determined

by discounting the future cash flows associated with that asset. If the intent is to hold the asset for sale and certain other criteria are met

(e.g., the asset can be disposed of currently, appropriate levels of authority have approved the sale, and there is an active program to locate

a buyer), the impairment test involves comparing the asset’s carrying value to its estimated fair value. To the extent the carrying value is

greater than the asset’s estimated fair value, an impairment charge is recognized for the difference. Significant judgments in this area

involve determining whether a triggering event has occurred, determining the future cash flows for the assets involved and selecting the

appropriate discount rate to be applied in determining estimated fair value. In 2009, 2008 and 2007, there were no significant long-lived

asset impairment charges.

Goodwill and Indefinite-lived Intangible Assets

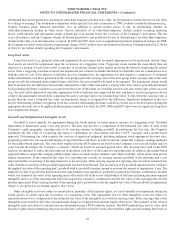

Goodwill is tested annually for impairment during the fourth quarter or earlier upon occurrence of a triggering event. Goodwill

impairment is determined using a two-step process. The first step involves a comparison of the estimated fair value of each of the

Company’s eight geographic reporting units to its carrying amount, including goodwill. In performing the first step, the Company

determines the fair value of a reporting unit using a combination of a discounted cash flow (“DCF”) analysis and a market-based

approach. Determining fair value requires the exercise of significant judgment, including judgment about appropriate discount rates,

perpetual growth rates, the amount and timing of expected future cash flows, as well as relevant comparable company earnings multiples

for the market-based approach. The cash flows employed in the DCF analyses are based on the Company’s most recent budget and, for

years beyond the budget, the Company’s estimates, which are based on assumed growth rates. The discount rates used in the DCF

analyses are intended to reflect the risks inherent in the future cash flows of the respective reporting units. In addition, the market-based

approach utilizes comparable company public trading values, research analyst estimates and, where available, values observed in private

market transactions. If the estimated fair value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is not

impaired and the second step of the impairment test is not necessary. If the carrying amount of a reporting unit exceeds its estimated fair

value, then the second step of the goodwill impairment test must be performed. The second step of the goodwill impairment test compares

the implied fair value of the reporting unit’s goodwill with its goodwill carrying amount to measure the amount of impairment, if any. The

implied fair value of goodwill is determined in the same manner as the amount of goodwill recognized in a business combination. In other

words, the estimated fair value of the reporting unit is allocated to all of the assets and liabilities of that unit (including any unrecognized

intangible assets) as if the reporting unit had been acquired in a business combination and the fair value of the reporting unit was the

purchase price paid. If the carrying amount of the reporting unit’s goodwill exceeds the implied fair value of that goodwill, an impairment

charge is recognized in an amount equal to that excess.

Other intangible assets not subject to amortization, primarily cable franchise rights, are tested annually for impairment during the

fourth quarter or earlier upon the occurrence of a triggering event. The impairment test for other intangible assets not subject to

amortization involves a comparison of the estimated fair value of the intangible asset with its carrying value. If the carrying value of the

intangible asset exceeds its fair value, an impairment charge is recognized in an amount equal to that excess. The estimates of fair value of

intangible assets not subject to amortization are determined using a DCF valuation analysis. The DCF methodology used to value cable

franchise rights entails identifying the projected discrete cash flows related to such cable franchise rights and discounting them back to

65

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)