Time Warner Cable 2009 Annual Report Download - page 64

Download and view the complete annual report

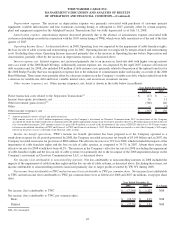

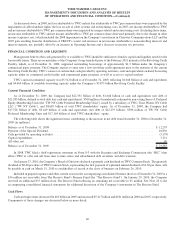

Please find page 64 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of $23.639 billion. Based on TWC’s fixed-rate debt obligations outstanding at December 31, 2009, a 25 basis point increase or decrease

in the level of interest rates would, respectively, decrease or increase the fair value of the fixed-rate debt by approximately $427 million.

Such potential increases or decreases are based on certain simplifying assumptions, including a constant level of fixed-rate debt and an

immediate, across-the-board increase or decrease in the level of interest rates with no other subsequent changes for the remainder of the

period.

Variable-rate Debt

As of December 31, 2009, TWC had an outstanding balance of variable-rate debt of $1.261 billion. Based on TWC’s variable-rate

debt obligations outstanding at December 31, 2009, each 25 basis point increase or decrease in the level of interest rates would,

respectively, increase or decrease TWC’s annual interest expense and related cash payments by approximately $3 million. Such potential

increases or decreases are based on certain simplifying assumptions, including a constant level of variable-rate debt for all maturities and

an immediate, across-the-board increase or decrease in the level of interest rates with no other subsequent changes for the remainder of

the period.

Interest Rate Derivative Transactions

The Company is exposed to the market risk of adverse changes in interest rates. To manage the volatility relating to these exposures,

the Company’s policy is to maintain a mix of fixed-rate and variable-rate debt by entering into various interest rate derivative transactions

as described below to help achieve that mix. Using interest rate swaps, the Company agrees to exchange, at specified intervals, the

difference between fixed and variable interest amounts calculated by reference to an agreed-upon notional principal amount.

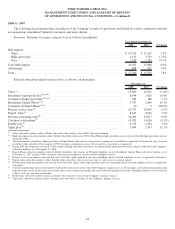

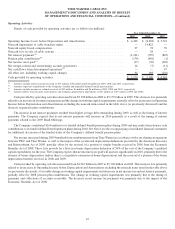

The following table summarizes the terms of the Company’s existing fixed to variable interest rate swaps as of December 31, 2009:

Maturities ................................................................................ 2012-2015

Notional amount (in millions) ................................................................. $ 5,250

Average pay rate (variable based on LIBOR plus variable margins) ...................................... 4.03%

Average receive rate (fixed) ................................................................... 6.24%

Estimated fair value (in millions) ............................................................... $ (12)

The notional amounts of interest rate instruments, as presented in the above table, are used to measure interest to be paid or received

and do not represent the amount of exposure to credit loss. Interest rate swaps represent an integral part of the Company’s interest rate risk

management program, with a benefit to interest expense, net, in 2009 of $30 million.

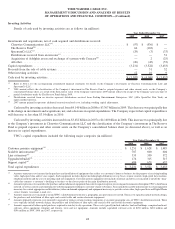

Equity Risk

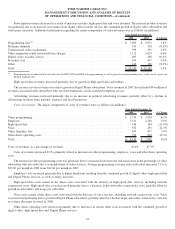

TWC is also exposed to market risk as it relates to changes in the market value of its investments. TWC invests in equity instruments

of companies for operational and strategic business purposes. These investments are subject to significant fluctuations in fair market

value due to volatility in the general equity markets and the specific industries in which the companies operate. As of December 31, 2009,

TWC had $975 million of investments, which included $691 million related to SpectrumCo LLC and $207 million related to Clearwire

Communications LLC.

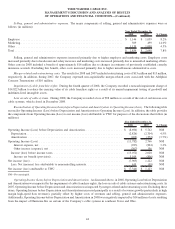

Prior to 2007, some of TWC’s employees were granted options to purchase shares of Time Warner common stock in connection with

their past employment with subsidiaries and affiliates of Time Warner, including TWC. Upon the exercise of Time Warner stock options

held by TWC employees, TWC is obligated to reimburse Time Warner for the excess of the market price of Time Warner common stock

on the day of exercise over the option exercise price (the “intrinsic” value of the award). Prior to the Separation, TWC recorded an equity

award reimbursement obligation for the intrinsic value of vested and outstanding Time Warner stock options held by TWC employees.

This liability was adjusted each reporting period to reflect changes in the market price of Time Warner common stock and the number of

Time Warner stock options held by TWC employees with an offsetting adjustment to TWC shareholders’ equity. Beginning on March 12,

2009, the date of the Separation, TWC began accounting for the equity award reimbursement obligation as a derivative financial

instrument because, as of such date, Time Warner is no longer a controlling shareholder of the Company. The Company records the equity

award reimbursement obligation at fair value in the consolidated balance sheet, which is estimated using the Black-Scholes model, and,

on March 12, 2009, TWC established a liability of $16 million for the fair value of the equity award reimbursement obligation in other

liabilities with an offsetting adjustment to TWC shareholders’ equity in the consolidated balance sheet. The change in the equity award

reimbursement obligation fluctuates primarily with the fair value and expected volatility of Time Warner common stock and is recorded

in earnings in the period of change. For the year ended December 31, 2009, TWC recognized a loss of $21 million in other income

52

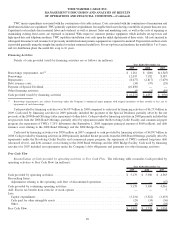

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)