Time Warner Cable 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. SALE OF CERTAIN CABLE SYSTEMS

In December 2008, the Company sold a group of small cable systems located in areas outside of the Company’s core geographic

clusters. The sale price was $54 million, of which $3 million was included in receivables in the consolidated balance sheet as of

December 31, 2008. The Company recorded a pretax loss of $58 million on the sale of these systems, which is included in loss on sale of

cable systems in the consolidated statement of operations and pretax (gain) loss on asset sales in the consolidated statement of cash flows

for the year ended December 31, 2008.

The closing of the Adelphia/Comcast Transactions, which included the Company’s acquisition from Adelphia of certain cable

systems in Mooresville, Cornelius, Davidson and unincorporated Mecklenburg County, North Carolina, triggered a right of first refusal

under the franchise agreements covering these systems. These municipalities exercised their right to acquire these systems and, as a

result, on December 19, 2007, these cable systems were sold for $52 million. The sale of these systems did not have a material impact on

the Company’s results of operations or cash flows.

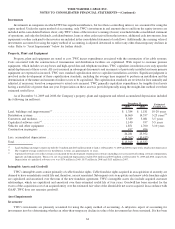

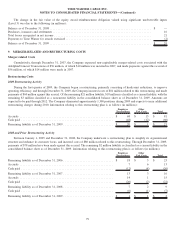

7. DEBT AND MANDATORILY REDEEMABLE PREFERRED EQUITY

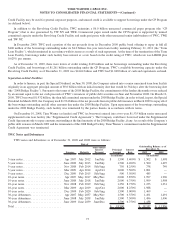

Debt and mandatorily redeemable preferred equity as of December 31, 2009 and 2008 were as follows:

Maturity

Interest

Rate 2009 2008

Outstanding Balance as of

December 31,

(in millions)

Credit facilities and commercial paper program

(a)(b)

..................... 2011 0.484%

(c)

$ 1,261 $ 3,045

TWE notes and debentures ........................................ 2012-2033 7.844%

(c)

2,702 2,714

TWC notes and debentures ........................................ 2012-2039 6.176%

(d)

18,357 11,956

Capital leases and other

(e)

........................................ 11 13

Total debt .................................................... 22,331 17,728

TW NY Cable Preferred Membership Units ........................... 2013 8.210% 300 300

Total debt and mandatorily redeemable preferred equity . . ................ $ 22,631 $ 18,028

(a)

TWC’s unused committed capacity was $5.512 billion as of December 31, 2009, reflecting $1.048 billion in cash and equivalents and $4.464 billion of available

borrowing capacity under the Revolving Credit Facility (which reflects a reduction of $149 million for outstanding letters of credit backed by the Revolving Credit

Facility).

(b)

Outstanding balance amount as of December 31, 2009 excludes an unamortized discount on commercial paper of $1 million (none as of December 31, 2008).

(c)

Rate represents a weighted-average effective interest rate as of December 31, 2009.

(d)

Rate represents a weighted-average effective interest rate as of December 31, 2009 and includes the effects of derivative financial instruments.

(e)

Amount includes $1 million of debt due within one year as of December 31, 2008 (none as of December 31, 2009), which primarily relates to capital lease obligations.

Credit Facilities

Revolving Credit Facility, Term Loan Facility and Commercial Paper Program

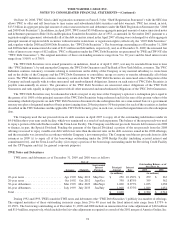

As of December 31, 2009, the Company has a $5.875 billion senior unsecured five-year revolving credit facility provided by a group

of major banks and other financial institutions maturing February 15, 2011 (the “Revolving Credit Facility”). The Company’s obligations

under the Revolving Credit Facility are guaranteed by TWE and TW NY. Borrowings under the Revolving Credit Facility bear interest at

a rate based on the credit rating of TWC, which rate was LIBOR plus 0.35% per annum at December 31, 2009. In addition, TWC is

required to pay a facility fee on the aggregate commitments under the Revolving Credit Facility at a rate determined by the credit rating of

TWC, which rate was 0.10% per annum at December 31, 2009. TWC may also incur an additional usage fee of 0.10% per annum on the

outstanding loans and other extensions of credit under the Revolving Credit Facility if and when such amounts exceed 50% of the

aggregate commitments thereunder.

The Revolving Credit Facility provides same-day funding capability and a portion of the commitment, not to exceed $500 million at

any time, may be used for the issuance of letters of credit. The Revolving Credit Facility contains a maximum leverage ratio covenant of

5.0 times the consolidated EBITDA of TWC (as defined in the Revolving Credit Facility). The terms and related financial metrics

associated with the leverage ratio are defined in the agreement. At December 31, 2009, TWC was in compliance with the leverage

covenant, with a leverage ratio, calculated in accordance with the agreement, of approximately 3.3 times. The Revolving Credit Facility

does not contain any credit ratings-based defaults or covenants or any ongoing covenant or representations specifically relating to a

material adverse change in TWC’s financial condition or results of operations. The Revolving Credit Facility also does not contain

borrowing restrictions due to material adverse changes in the Company’s business or market disruption. Borrowings under the Revolving

72

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)