Time Warner Cable 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Clearwire Investment

TWC holds an indirect equity interest in Clearwire Corporation (“Clearwire”), which was formed by the combination of the respective

wireless broadband businesses of Sprint Nextel Corporation (“Sprint”) and Clearwire Communications LLC, an operating subsidiary of

Clearwire (the “Clearwire Investment”). The Clearwire Investment is focused on deploying the first nationwide fourth-generation (“4G”)

wireless network to provide mobile broadband services to wholesale and retail customers. In November 2008, TWC, Intel Corporation

(“Intel”), Google Inc., Comcast and Bright House Networks, LLC (“Bright House”) invested $3.2 billion in Clearwire Communications

LLC, of which $550 million was contributed by TWC. In connection with the initial investment, TWC entered into wholesale agreements

with Clearwire and Sprint that allow TWC to offer wireless services utilizing Clearwire’s 4G WiMax network and Sprint’s third-generation

code-division multiple access network. The Company allocated $20 million of its initial $550 million investment in Clearwire

Communications LLC to its rights under these agreements, which the Company believes represents the fair value of favorable pricing

provisions contained in the agreements. Such assets are included in other assets in the consolidated balance sheet as of December 31, 2008

and are being amortized over the estimated lives of the agreements. In November 2009, TWC, Sprint, Intel, Comcast, Bright House and

Eagle River Holdings, LLC collectively agreed to invest up to an additional $1.564 billion in Clearwire Communications LLC, of which

TWC agreed to fund approximately $103 million. During the fourth quarter of 2009, TWC contributed $97 million to Clearwire

Communications LLC and expects to make its remaining contribution during the first quarter of 2010.

As of December 31, 2009, the Company’s equity interest in the underlying net assets of the Clearwire Investment exceeds the

carrying value of the Company’s investment in Clearwire by approximately $200 million. Such difference relates to intangible assets not

subject to amortization and, therefore, is not being amortized. During 2008, the Company recorded a noncash pretax impairment charge

of $367 million on its Clearwire investment as a result of a significant decline in the estimated fair value of the investment, which is

included in other income (expense), net in the consolidated statement of operations. The primary input in estimating the fair value of

TWC’s investment in Clearwire was the quoted market value of Clearwire Corporation publicly traded Class A shares at December 31,

2008, which declined significantly from May 2008, the date TWC agreed to make its investment.

TKCCP Joint Venture

Texas and Kansas City Cable Partners, L.P. (“TKCCP”) was a 50-50 joint venture between a consolidated subsidiary of TWC

(TWE-A/N) and Comcast. On January 1, 2007, TKCCP distributed its assets to its partners. TWC received certain cable assets located in

Kansas City, south and west Texas and New Mexico (the “Kansas City Pool”) and Comcast received the pool of assets consisting of the

Houston cable systems (the “Houston Pool”). TWC began consolidating the results of the Kansas City Pool on January 1, 2007. TKCCP

was formally dissolved on May 15, 2007. For accounting purposes, TWC treated the distribution of TKCCP’s assets as a sale of TWC’s

50% equity interest in the Houston Pool and as an acquisition of Comcast’s 50% equity interest in the Kansas City Pool. As a result of the

sale of TWC’s 50% equity interest in the Houston Pool, TWC recorded a pretax gain of $146 million in the first quarter of 2007, which is

included as a component of other income (expense), net, in the consolidated statement of operations for the year ended December 31,

2007. In 2009, Comcast and TWC finalized the post-closing adjustment associated with the sale of the Houston Pool, and the Company

recorded a $12 million gain, which is included in other income (expense), net, in the consolidated statement of operations for the year

ended December 31, 2009.

12. INCOME TAXES

Prior to the Separation, TWC was not a separate taxable entity for U.S. federal and various state income tax purposes and its results

were included in the consolidated U.S. federal and certain consolidated or combined state income tax returns of Time Warner. For taxable

periods after the Separation, TWC will file separate U.S. federal and consolidated or combined state income tax returns. The following

income tax information has been prepared assuming TWC was a stand-alone taxpayer for all periods presented.

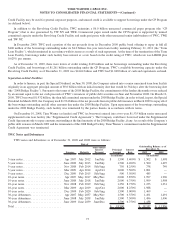

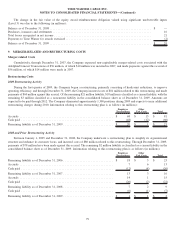

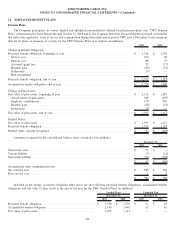

Current and deferred income tax (benefit) provision provided on income from continuing operations are as follows (in millions):

2009 2008 2007

Year Ended December 31,

Federal:

Current . . ....................................................... $ 83 $ (188) $ 356

Deferred . ....................................................... 543 (3,967) 321

State:

Current . . ....................................................... 61 39 67

Deferred . ....................................................... 133 (993) 62

Total ........................................................... $ 820 $ (5,109) $ 806

82

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)