Time Warner Cable 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

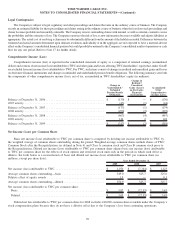

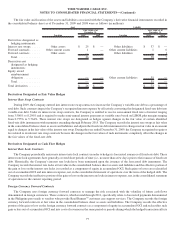

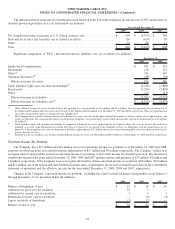

The change in the fair value of the equity award reimbursement obligation valued using significant unobservable inputs

(Level 3) was due to the following (in millions):

Balance as of December 31, 2008 ............................................................... $ —

Purchases, issuances and settlements ............................................................. 16

Total losses recognized in net income ............................................................ 21

Payments to Time Warner for awards exercised ..................................................... (2)

Balance as of December 31, 2009 ............................................................... $ 35

9. MERGER-RELATED AND RESTRUCTURING COSTS

Merger-related Costs

Cumulatively, through December 31, 2007, the Company expensed non-capitalizable merger-related costs associated with the

Adelphia/Comcast Transactions of $56 million, of which $10 million was incurred in 2007, and made payments against this accrual of

$56 million, of which $14 million were made in 2007.

Restructuring Costs

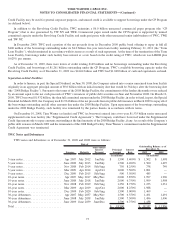

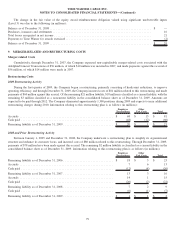

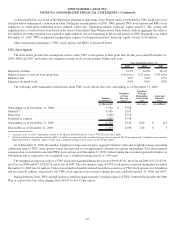

2009 Restructuring Activity

During the first quarter of 2009, the Company began a restructuring, primarily consisting of headcount reductions, to improve

operating efficiency, and through December 31, 2009, the Company incurred costs of $81 million related to this restructuring and made

payments of $60 million against this accrual. Of the remaining $21 million liability, $18 million is classified as a current liability, with the

remaining $3 million classified as a noncurrent liability in the consolidated balance sheet as of December 31, 2009. Amounts are

expected to be paid through 2012. The Company eliminated approximately 1,300 positions during 2009 and expects to incur additional

restructuring charges during 2010. Information relating to this restructuring plan is as follows (in millions):

Employee

Terminations

Other

Exit Costs Total

Accruals . . . ....................................................... $ 68 $ 13 $ 81

Cash paid . . ....................................................... (48) (12) (60)

Remaining liability as of December 31, 2009 ............................... $ 20 $ 1 $ 21

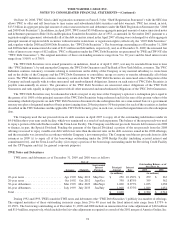

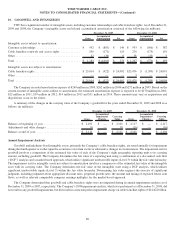

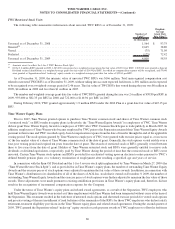

2008 and Prior Restructuring Activity

Between January 1, 2005 and December 31, 2008, the Company underwent a restructuring plan to simplify its organizational

structure and enhance its customer focus, and incurred costs of $80 million related to this restructuring. Through December 31, 2009,

payments of $78 million have been made against this accrual. The remaining $2 million liability is classified as a current liability in the

consolidated balance sheet as of December 31, 2009. Information relating to this restructuring plan is as follows (in millions):

Employee

Terminations

Other

Exit Costs Total

Remaining liability as of December 31, 2006 ............................... $ 18 $ 5 $ 23

Accruals . . . ....................................................... 7 6 13

Cash paid . . ....................................................... (12) (8) (20)

Remaining liability as of December 31, 2007 ............................... 13 3 16

Accruals . . . ....................................................... 14 1 15

Cash paid . . ....................................................... (20) (2) (22)

Remaining liability as of December 31, 2008 ............................... 7 2 9

Cash paid . . ....................................................... (6) (1) (7)

Remaining liability as of December 31, 2009 ............................... $ 1 $ 1 $ 2

79

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)