Time Warner Cable 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Legal Contingencies

The Company is subject to legal, regulatory and other proceedings and claims that arise in the ordinary course of business. The Company

records an estimated liability for those proceedings and claims arising in the ordinary course of business when the loss from such proceedings and

claims becomes probable and reasonably estimable. The Company reviews outstanding claims with internal, as well as external, counsel to assess

the probability and the estimates of loss. The Company reassesses the risk of loss as new information becomes available and adjusts liabilities as

appropriate. The actual cost of resolving a claim may be substantially different from the amount of the liability recorded. Differences between the

estimated and actual amounts determined upon ultimate resolution, individually or in the aggregate, are not expected to have a material adverse

effect on the Company’s consolidated financial position but could possibly be material to the Company’s consolidated results of operations or cash

flow for any one period. Refer to Note 17 for further details.

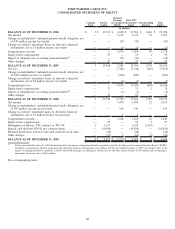

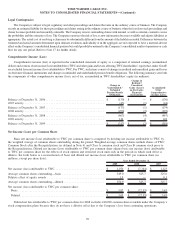

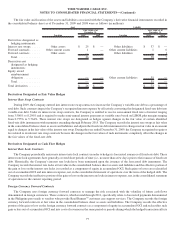

Comprehensive Income (Loss)

Comprehensive income (loss) is reported in the consolidated statement of equity as a component of retained earnings (accumulated

deficit) and consists of net income (loss) attributable to TWC and other gains and losses affecting TWC shareholders’ equity that, under GAAP,

are excluded from net income (loss) attributable to TWC. For TWC, such items consist of changes in realized and unrealized gains and losses

on derivative financial instruments and changes in unfunded and underfunded pension benefit obligations. The following summary sets forth

the components of other comprehensive income (loss), net of tax, accumulated in TWC shareholders’ equity (in millions):

Change in

Underfunded /

Unfunded

Pension Benefit

Obligation

Change in

Realized /

Unrealized

Gains (Losses)

on Derivative

Financial

Instruments

Accumulated

Other

Comprehensive

Income (Loss)

Balance at December 31, 2006 .................................... $ (130) $ — $ (130)

2007 activity ................................................. (43) (1) (44)

Balance at December 31, 2007 .................................... (173) (1) (174)

2008 activity ................................................. (290) (3) (293)

Balance at December 31, 2008 .................................... (463) (4) (467)

2009 activity ................................................. 146 2 148

Balance at December 31, 2009 .................................... $ (317) $ (2) $ (319)

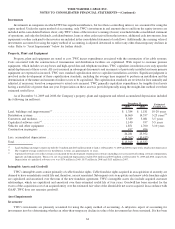

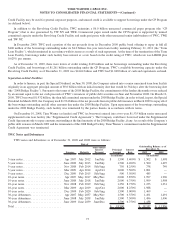

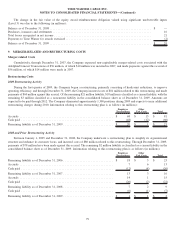

Net Income (Loss) per Common Share

Basic net income (loss) attributable to TWC per common share is computed by dividing net income attributable to TWC by

the weighted average of common shares outstanding during the period. Weighted-average common shares include shares of TWC

Common Stock after the Recapitalization (as defined in Note 4) and Class A common stock and Class B common stock prior to

the Recapitalization. Diluted net income (loss) attributable to TWC per common share adjusts basic net income (loss) attributable

to TWC per common share for the effects of stock options and restricted stock units only in the periods in which such effect is

dilutive. Set forth below is a reconciliation of basic and diluted net income (loss) attributable to TWC per common share (in

millions, except per share data):

2009 2008 2007

Year Ended December 31,

Net income (loss) attributable to TWC .............................. $ 1,070 $ (7,344) $ 1,123

Average common shares outstanding—basic .......................... 349.0 325.7 325.6

Dilutive effect of equity awards ................................... 1.9 — 0.1

Average common shares outstanding—diluted ......................... 350.9 325.7 325.7

Net income (loss) attributable to TWC per common share:

Basic ..................................................... $ 3.07 $ (22.55) $ 3.45

Diluted.................................................... $ 3.05 $ (22.55) $ 3.45

Diluted net loss attributable to TWC per common share for 2008 excludes 240,000 common shares issuable under the Company’s

stock compensation plans because they do not have a dilutive effect due to the Company’s loss from continuing operations.

70

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)