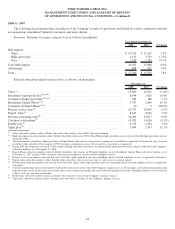

Time Warner Cable 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

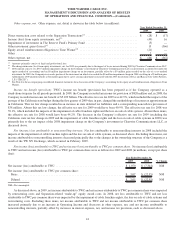

March 11, 2009 of TWC’s outstanding Class A common stock and Class B common stock (the “Special Dividend”). Following the payment

of the Special Dividend, each outstanding share of TWC Class A common stock and TWC Class B common stock was automatically

converted (the “Recapitalization”) into one share of common stock, par value $0.01 per share (the “TWC Common Stock”). TWC’s

separation from Time Warner (the “Separation”) was effected as a pro rata dividend of all shares of TWC Common Stock held by Time

Warner to holders of record of Time Warner’s common stock (the “Spin-Off Dividend” or the “Distribution”). The TW NY Exchange, the

Special Dividend, the Recapitalization, the Separation and the Distribution collectively are referred to as the “Separation Transactions.”

To pay a portion of the Special Dividend, on March 12, 2009, TWC borrowed (i) the full committed amount of $1.932 billion under

its 364-day senior unsecured term loan facility (the “2008 Bridge Facility”) and (ii) approximately $3.3 billion under the Revolving

Credit Facility. The Company funded the remainder of the Special Dividend with approximately $5.6 billion of cash on hand. See

“—2009 Bond Offerings and Termination of Lending Commitments” below for further details regarding the termination of the 2008

Bridge Facility.

In connection with the Separation Transactions, on March 12, 2009, the Company implemented a reverse stock split of the TWC

Common Stock (the “TWC Reverse Stock Split”) at a 1-for-3 ratio, effective immediately after the Recapitalization. The shares of TWC

Common Stock distributed in the Spin-Off Dividend reflected both the Recapitalization and the TWC Reverse Stock Split.

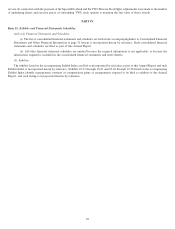

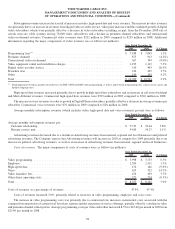

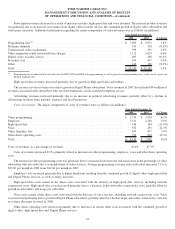

During 2009 and 2008, the Company incurred pretax costs related to the Separation, which have been reflected in the Company’s

consolidated statement of operations as follows (in millions):

2009 2008

Year Ended December 31,

Other income (expense), net ........................................................ $ (28) $ (17)

Interest expense, net .............................................................. (13) (45)

Pretax costs related to the Separation . . . .............................................. $ (41) $ (62)

The Separation-related costs recorded in other income (expense), net, consist of direct transaction costs (e.g., legal and professional

fees) and such costs recorded in interest expense, net, consist of debt issuance costs. The debt issuance costs for 2009 primarily relate to

the portion of the upfront loan fees for the 2008 Bridge Facility that was recognized as expense due to the repayment of all borrowings

outstanding under, and the resulting termination of, such facility with a portion of the net proceeds of the March 2009 Bond Offering (as

defined below).

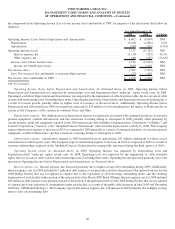

2009 Bond Offerings and Termination of Lending Commitments

In 2009, TWC issued, in total, $6.5 billion in aggregate principal amount of senior unsecured notes and debentures under a shelf

registration statement on Form S-3 in three public underwritten offerings (the “2009 Bond Offerings”). The bond offering in March 2009

consisted of $1.0 billion principal amount of 7.50% notes due 2014 and $2.0 billion principal amount of 8.25% notes due 2019 (the

“March 2009 Bond Offering”). The bond offering in June 2009 consisted of $1.5 billion principal amount of 6.75% debentures due 2039

(the “June 2009 Bond Offering”). The bond offering in December 2009 consisted of $500 million principal amount of 3.50% notes due

2015 and $1.5 billion principal amount of 5.00% notes due 2020 (the “December 2009 Bond Offering”). TWC’s obligations under the

debt securities issued in the 2009 Bond Offerings are guaranteed by Time Warner Entertainment Company, L.P. (“TWE”) and TW NY.

The Company used $1.934 billion of the net proceeds from the March 2009 Bond Offering to repay all of the borrowings outstanding

under the 2008 Bridge Facility, as well as accrued interest and commitment fees, and such facility was terminated by the parties thereto in

accordance with its terms. Additionally, as a result of the March 2009 Bond Offering and the termination of the 2008 Bridge Facility, the

Company terminated Time Warner’s commitment (as lender) under a two-year $1.535 billion senior unsecured supplemental term loan

facility in accordance with its terms. The Company used the remaining net proceeds from the March 2009 Bond Offering to repay a

portion of the borrowings outstanding under the Revolving Credit Facility.

The Company used the net proceeds of $1.444 billion from the June 2009 Bond Offering and a portion of the net proceeds of

$1.957 billion from the December 2009 Bond Offering to repay all of the outstanding borrowings under its five-year term loan facility,

which terminated in accordance with its terms as a result of such repayment. The remaining net proceeds from the December 2009 Bond

Offering were used to repay a portion of the borrowings outstanding under the Company’s commercial paper program and for general

corporate purposes.

See Note 7 to the accompanying consolidated financial statements for further details regarding the 2009 Bond Offerings.

34

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)