Time Warner Cable 2009 Annual Report Download - page 73

Download and view the complete annual report

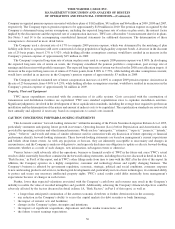

Please find page 73 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Description of Business

Time Warner Cable Inc. (together with its subsidiaries, “TWC” or the “Company”) is the second-largest cable operator in the U.S.,

with technologically advanced, well-clustered systems located mainly in five geographic areas – New York State (including New York

City), the Carolinas, Ohio, southern California (including Los Angeles) and Texas. As of December 31, 2009, TWC served

approximately 14.6 million residential and commercial customers who subscribed to one or more of its three primary subscription

services – video, high-speed data and voice – totaling approximately 26.4 million primary service units.

As discussed more fully in Note 4, on March 12, 2009, TWC completed its separation from Time Warner Inc. (“Time Warner”),

which, prior to the Separation Transactions (as defined in Note 4), owned approximately 84% of the common stock of TWC (representing

a 90.6% voting interest) and a 12.43% non-voting common stock interest in TW NY Cable Holding Inc. (“TW NY”), a subsidiary of

TWC. As a result of the separation, Time Warner no longer has an ownership interest in TWC or TW NY.

TWC offers video, high-speed data and voice services over its broadband cable systems to residential and commercial customers.

TWC markets its services separately and in “bundled” packages of multiple services and features. As of December 31, 2009, 57.3% of

TWC’s residential and commercial customers subscribed to two or more of its primary services, including 23.7% of its customers who

subscribed to all three primary services. TWC also sells advertising to a variety of national, regional and local advertising customers.

Basis of Presentation

Changes in Basis of Presentation

TWC Reverse Stock Split. As discussed more fully in Note 4, in connection with TWC’s separation from Time Warner, on

March 12, 2009, the Company implemented a reverse stock split of TWC Common Stock (as defined in Note 4) at a 1-for-3 ratio (the

“TWC Reverse Stock Split”). The Company has recast the presentation of share and per share data in the consolidated financial

statements to reflect the TWC Reverse Stock Split.

Transactions with Affiliated Parties. As discussed more fully in Notes 4 and 15, upon completion of TWC’s separation from Time

Warner, Time Warner and its affiliates are no longer related parties to TWC. For the periods prior to TWC’s separation from Time

Warner, TWC has disclosed transactions with Time Warner and its affiliates in the financial statements as related party transactions.

Noncontrolling Interests. As discussed more fully in Note 2, on January 1, 2009, TWC adopted authoritative guidance issued by

the Financial Accounting Standards Board (“FASB”) that establishes accounting and reporting standards for a noncontrolling interest in a

subsidiary, including the accounting treatment upon the deconsolidation of a subsidiary. As required by this guidance, the Company has

recast the presentation of noncontrolling interests in the prior year financial statements so that they are comparable to those of 2009.

Basis of Consolidation

The consolidated financial statements include 100% of the assets, liabilities, revenues, expenses and cash flows of TWC and all

entities in which TWC has a controlling voting interest. The consolidated financial statements include the results of Time Warner

Entertainment-Advance/Newhouse Partnership (“TWE-A/N”) only for the TWE-A/N cable systems that are controlled by TWC and for

which TWC holds an economic interest. Intercompany accounts and transactions between consolidated companies have been eliminated

in consolidation.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires

management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and footnotes

thereto. Actual results could differ from those estimates.

Significant estimates inherent in the preparation of the consolidated financial statements include accounting for asset impairments,

allowances for doubtful accounts, investments, depreciation and amortization, business combinations, pension benefits, equity-based

compensation, income taxes, contingencies and certain programming arrangements. Allocation methodologies used to prepare the

consolidated financial statements are based on estimates and have been described in the notes, where appropriate.

Reclassifications

Certain reclassifications have been made to the prior years’ financial information to conform to the December 31, 2009 presentation.

61