Time Warner Cable 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

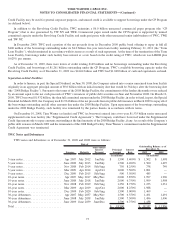

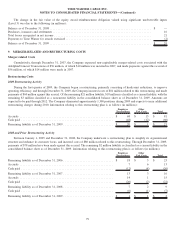

On June 16, 2008, TWC filed a shelf registration statement on Form S-3 (the “Shelf Registration Statement”) with the SEC that

allows TWC to offer and sell from time to time senior and subordinated debt securities and debt warrants. TWC has issued, in total,

$13.5 billion in aggregate principal amount of senior unsecured notes and debentures under the Shelf Registration Statement (the “2008

and 2009 Debt Securities”). In addition, in April 2007, TWC issued $5.0 billion in aggregate principal amount of senior unsecured notes

and debentures pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended. In November 2007, pursuant to a

registration rights agreement, substantially all of the debt securities issued in the April 2007 offering were exchanged for a like aggregate

principal amount of registered debt securities without transfer restrictions or registration rights (collectively, the “2007 Debt Securities”

and, together with the 2008 and 2009 Debt Securities, the “TWC Debt Securities”). The borrowings outstanding as of December 31, 2009

and 2008 include an unamortized discount of $131 million and $44 million, respectively, and, as of December 31, 2009, the estimated fair

value of interest rate swaps of $12 million. TWC’s obligations under the TWC Debt Securities are guaranteed by TWE and TW NY (the

“TWC Debt Guarantors”). The original maturities of these outstanding issuances range from 5 to 30 years and the fixed interest rates

range from 3.500% to 8.750%.

The TWC Debt Securities were issued pursuant to an indenture, dated as of April 9, 2007, as it may be amended from time to time

(the “TWC Indenture”), by and among the Company, the TWC Debt Guarantors and The Bank of New York Mellon, as trustee. The TWC

Indenture contains customary covenants relating to restrictions on the ability of the Company or any material subsidiary to create liens

and on the ability of the Company and the TWC Debt Guarantors to consolidate, merge or convey or transfer substantially all of their

assets. The TWC Indenture also contains customary events of default. The TWC Debt Securities are unsecured senior obligations of the

Company and rank equally with its other unsecured and unsubordinated obligations. Interest on each series of TWC Debt Securities is

payable semi-annually in arrears. The guarantees of the TWC Debt Securities are unsecured senior obligations of the TWC Debt

Guarantors and rank equally in right of payment with all other unsecured and unsubordinated obligations of the TWC Debt Guarantors.

The TWC Debt Securities may be redeemed in whole or in part at any time at the Company’s option at a redemption price equal to

the greater of (i) 100% of the principal amount of the TWC Debt Securities being redeemed and (ii) the sum of the present values of the

remaining scheduled payments on such TWC Debt Securities discounted to the redemption date on a semi-annual basis at a government

treasury rate plus a designated number of basis points (ranging from 20 basis points to 50 basis points) for each of the securities as further

described in the TWC Indenture and the applicable TWC Debt Security, plus, in each case, accrued but unpaid interest to the redemption

date.

The Company used the net proceeds from its debt issuance in April 2007 to repay all of the outstanding indebtedness under its

$4.0 billion three-year term credit facility, which was terminated as a result of such repayment. The balance of the net proceeds was used

to repay a portion of the indebtedness under the Term Loan Facility. The Company used the net proceeds from its debt issuances in 2008

to finance, in part, the Special Dividend. Pending the payment of the Special Dividend, a portion of the net proceeds from the 2008

offerings was used to repay variable-rate debt with lower rates than the interest rates on the debt securities issued in the 2008 offerings,

and the remainder was invested in accordance with the Company’s investment policy. The Company used the net proceeds from its debt

issuances in 2009 (i) to repay all of the borrowings outstanding under the 2008 Bridge Facility (including accrued interest and

commitment fees), and the Term Loan Facility, (ii) to repay a portion of the borrowings outstanding under the Revolving Credit Facility

and the CP Program and (iii) for general corporate purposes.

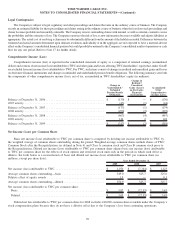

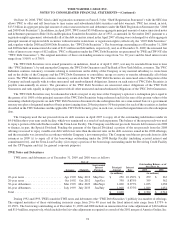

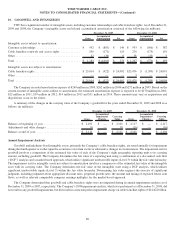

TWE Notes and Debentures

TWE notes and debentures as of December 31, 2009 and 2008 were as follows:

Issuance Maturity

Semi-annual

Interest

Payment

Principal

Amount

Interest

Rate 2009 2008

Outstanding Balance as of

December 31,

Date of

(in millions) (in millions)

20-year notes ....................... Apr1992 May 2012 May/Nov $ 250 10.150% $ 259 $ 263

20-year notes ....................... Oct1992 Oct 2012 Apr/Oct 350 8.875% 359 362

30-year debentures ................... Mar1993 Mar 2023 Mar/Sept 1,000 8.375% 1,035 1,038

40-year debentures ................... July 1993 July 2033 Jan/July 1,000 8.375% 1,049 1,051

Total . . ........................... $ 2,600 $ 2,702 $ 2,714

During 1992 and 1993, TWE issued the TWE notes and debentures (the “TWE Debt Securities”) publicly in a number of offerings.

The original maturities of these outstanding issuances range from 20 to 40 years and the fixed interest rates range from 8.375% to

10.150%. The borrowings outstanding as of December 31, 2009 and 2008 include an unamortized fair value adjustment of $102 million

and $114 million, respectively, which includes the fair value adjustment recognized as a result of the 2001 merger of America Online, Inc.

74

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)