Time Warner Cable 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the valuation date. Significant judgments inherent in this analysis include the selection of appropriate discount rates, estimating the

amount and timing of estimated future cash flows attributable to cable franchise rights and identification of appropriate terminal growth

rate assumptions. The discount rates used in the DCF analyses are intended to reflect the risk inherent in the projected future cash flows

generated by the respective intangible assets.

In 2009 and 2007, there were no significant goodwill or cable franchise rights impairment charges. In 2008, the Company’s

impairment analysis did not result in any goodwill impairments, but did result in a noncash pretax impairment charge on cable franchise

rights of $14.822 billion. Refer to Note 10 for further details regarding the Company’s annual impairment analyses.

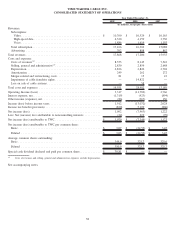

Revenues and Costs

Revenues are principally derived from video, high-speed data and voice services and advertising. Subscriber fees are recorded as

revenues in the period during which the service is provided. Subscription revenues received from subscribers who purchase bundled

services at a discounted rate are allocated to each product in a pro-rata manner based on the individual product’s determined fair value.

Installation revenues obtained from subscriber service connections are recognized as a component of Subscription revenues as the

connections are completed, as installation revenues recognized are less than the related direct selling costs. Advertising revenues,

including those from advertising purchased by programmers, are recognized in the period during which the advertisements are exhibited.

Video programming, high-speed data and voice costs are recorded as the services are provided. Video programming costs are

recorded based on the Company’s contractual agreements with its programming vendors. These contracts are generally multi-year

agreements that provide for the Company to make payments to the programming vendors at agreed upon market rates based on the

number of subscribers to which the Company provides the programming service. If a programming contract expires prior to the parties’

entry into a new agreement and the Company continues to distribute the service, management estimates the programming costs during

the period there is no contract in place. In doing so, management considers the previous contractual rates, inflation and the status of the

negotiations in determining its estimates. When the programming contract terms are finalized, an adjustment to programming expense is

recorded, if necessary, to reflect the terms of the new contract. Management also makes estimates in the recognition of programming

expense related to other items, such as the accounting for free periods and credits from service interruptions, as well as the allocation of

consideration exchanged between the parties in multiple-element transactions. Additionally, judgments are also required by management

when the Company purchases multiple services from the same programming vendor. In these scenarios, the total consideration provided

to the programming vendor is required to be allocated to the various services received based upon their respective fair values. Because

multiple services from the same programming vendor may be received over different contractual periods and may have different

contractual rates, the allocation of consideration to the individual services will have an impact on the timing of the Company’s expense

recognition.

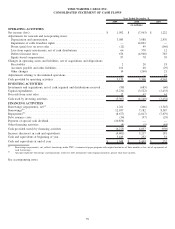

Launch fees received by the Company from programming vendors are recognized as a reduction of expense on a straight-line basis

over the life of the related programming arrangement. Amounts received from programming vendors representing the reimbursement of

marketing costs are recognized as a reduction of marketing expenses as the marketing services are provided.

Advertising costs are expensed upon the first exhibition of related advertisements. Marketing expense (including advertising), net of

certain reimbursements from programmers, was $563 million in 2009, $569 million in 2008 and $499 million in 2007.

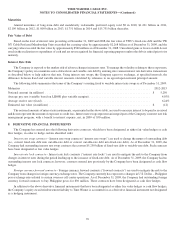

Multiple-element Transactions

Multiple-element transactions involve situations where judgment must be exercised in determining the fair value of the different

elements in a bundled transaction. As the term is used here, multiple-element arrangements can involve:

• Contemporaneous purchases and sales (e.g., the Company sells advertising services to a customer and at the same time

purchases programming services);

• Sales of multiple products and/or services (e.g., the Company sells video, high-speed data and voice services to a customer);

and/or

• Purchases of multiple products and/or services, or the settlement of an outstanding item contemporaneous with the purchase of

a product or service (e.g., the Company settles a dispute on an existing programming contract at the same time that it enters into

a new programming contract with the same programming vendor).

Contemporaneous Purchases and Sales

In the normal course of business, TWC enters into multiple-element transactions where the Company is simultaneously both a

customer and a vendor with the same counterparty. For example, when negotiating the terms of programming purchase contracts with

66

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)