Time Warner Cable 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Segments

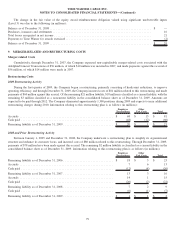

Public companies are required to disclose certain information about their reportable operating segments. Operating segments are

defined as significant components of an enterprise for which separate financial information is available and is evaluated on a regular basis

by the chief operating decision makers in deciding how to allocate resources to an individual segment and in assessing performance of the

segment. The Company has determined that it has only one reportable segment.

Subsequent Events

The Company has considered subsequent events through February 19, 2010, the date of issuance, in preparing the consolidated

financial statements and notes thereto.

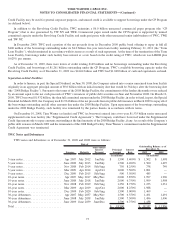

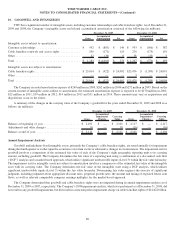

4. SEPARATION FROM TIME WARNER, RECAPITALIZATION AND TWC REVERSE STOCK SPLIT

On March 12, 2009, TWC’s separation from Time Warner was completed pursuant to a Separation Agreement dated as of May 20,

2008 (the “Separation Agreement”) between TWC and its subsidiaries, Time Warner Entertainment Company, L.P. (“TWE”) and TW

NY, and Time Warner and its subsidiaries, Warner Communications Inc. (“WCI”), Historic TW Inc. (“Historic TW”) and American

Television and Communications Corporation (“ATC”). In accordance with the Separation Agreement, on February 25, 2009, Historic

TW transferred its 12.43% non-voting common stock interest in TW NY to TWC in exchange for 80 million newly issued shares

(approximately 27 million shares after giving effect to the 1-for-3 TWC Reverse Stock Split discussed below) of TWC’s Class A common

stock (the “TW NY Exchange”). On March 12, 2009, TWC paid a special cash dividend of $10.27 per share ($30.81 per share after giving

effect to the 1-for-3 TWC Reverse Stock Split, aggregating $10.856 billion) to holders of record on March 11, 2009 of TWC’s

outstanding Class A common stock and Class B common stock (the “Special Dividend”). Following the payment of the Special Dividend,

each outstanding share of TWC Class A common stock and TWC Class B common stock was automatically converted (the

“Recapitalization”) into one share of common stock, par value $0.01 per share (the “TWC Common Stock”). TWC’s separation

from Time Warner (the “Separation”) was effected as a pro rata dividend of all shares of TWC Common Stock held by Time Warner to

holders of record of Time Warner’s common stock (the “Spin-Off Dividend” or the “Distribution”). The TW NY Exchange, the Special

Dividend, the Recapitalization, the Separation and the Distribution collectively are referred to as the “Separation Transactions.” To pay a

portion of the Special Dividend, on March 12, 2009, TWC borrowed (i) the full committed amount of $1.932 billion under the 2008

Bridge Facility (as defined in Note 7), and (ii) approximately $3.3 billion under the Revolving Credit Facility (as defined in Note 7). The

Company funded the remainder of the Special Dividend with approximately $5.6 billion of cash on hand.

In connection with the Separation Transactions, on March 12, 2009, the Company implemented the TWC Reverse Stock Split at a

1-for-3 ratio, effective immediately after the Recapitalization. The shares of TWC Common Stock distributed in the Spin-Off Dividend

reflected both the Recapitalization and the TWC Reverse Stock Split.

For the years ended December 31, 2009 and 2008, the Company expensed direct transaction costs (e.g., legal and professional fees)

related to the Separation of $28 million and $17 million, respectively, which are included as a component of other income (expense), net,

in the consolidated statement of operations.

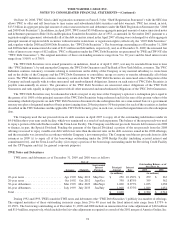

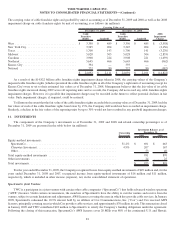

5. TRANSACTIONS WITH ADELPHIA AND COMCAST

On July 31, 2006, a subsidiary of TWC, Time Warner NY Cable LLC (“TW NY Cable”) and Comcast Corporation (“Comcast”)

completed their respective acquisitions of assets comprising in the aggregate substantially all of the cable assets of Adelphia

Communications Corporation (“Adelphia”) (the “Adelphia Acquisition”). Additionally, on July 31, 2006, immediately before the

closing of the Adelphia Acquisition, Comcast’s interests in TWC and TWE were redeemed (the “Redemptions”). Following the

Redemptions and the Adelphia Acquisition, on July 31, 2006, TW NY Cable and Comcast swapped certain cable systems, most of which

were acquired from Adelphia, in order to enhance TWC’s and Comcast’s respective geographic clusters of subscribers (the “Exchange”

and, together with the Adelphia Acquisition and the Redemptions, the “Adelphia/Comcast Transactions”). In February 2007, Adelphia’s

Chapter 11 reorganization plan became effective. Under the terms of the reorganization plan, substantially all of the shares of TWC

Class A common stock that Adelphia received as part of the payment for the systems TW NY Cable acquired from Adelphia were

distributed to Adelphia’s creditors. As a result, under applicable securities law regulations and provisions of the U.S. bankruptcy code,

TWC became a public company subject to the requirements of the Securities Exchange Act of 1934, as amended. On March 1, 2007,

TWC’s Class A common stock began trading on the New York Stock Exchange.

71

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)