The Hartford 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

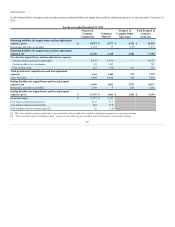

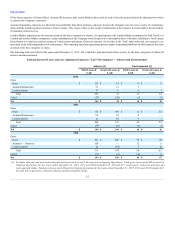

Reserve changes for accident years 2002 & Prior

The largest impacts of net reserve re-estimates are shown in the “2002 & Prior” accident years. The reserve deterioration is driven, in part, by deterioration of

reserves for asbestos, environmental, assumed casualty reinsurance, workers’ compensation, and general liability claims. Numerous actuarial assumptions

on assumed casualty reinsurance turned out to be low, including loss cost trends, particularly on excess of loss business, and the impact of deteriorating terms

and conditions.

The reserve re-estimates in calendar year 2003 include an increase in reserves of $2.6 billion related to reserve strengthening based on the Company’s

evaluation of its asbestos reserves. The reserve evaluation that led to the strengthening in calendar year 2003 confirmed the Company’s view of the existence of

a substantial long-term deterioration in the asbestos litigation environment. The reserve re-estimates in calendar years 2004 through 2006 were largely

attributable to reductions in the reinsurance recoverable asset associated with older, long-term casualty liabilities, and unexpected development on mature

claims in both general liability and workers’ compensation.

The reserve re-estimates during calendar year 2008 are largely driven by increases in asbestos, environmental and general liability reserves. The reserve re-

estimates in calendar years 2009, 2010 and 2011 are largely due to increases in asbestos and environmental reserves, resulting from the Company’s annual

evaluations of these liabilities. These reserve evaluations reflect deterioration in the litigation environment surrounding asbestos and environmental liabilities

during this period.

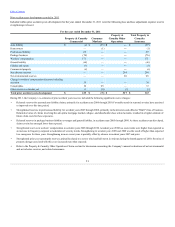

Reserve changes for accident years 2003 through 2007

During the 2007 calendar year, the Company refined its processes for allocating incurred but not reported (“IBNR”) reserves by accident year, resulting in a

reclassification of $347 of IBNR reserves from the 2003 to 2006 accident years to the 2002 and prior accident years. This reclassification of reserves by

accident year had no effect on total recorded reserves within any segment or on total recorded reserves for any line of business within a segment. Even after

considering the reclassification of IBNR reserves, accident years 2003 through 2007 show favorable development in calendar years 2004 through 2011. A

portion of the release comes from short-tail lines of business, where results emerge quickly. During calendar year 2005 and 2006, favorable re-estimates

occurred for both loss and allocated loss adjustment expenses. In addition, catastrophe reserves related to the 2004 and 2005 hurricanes developed favorably in

2006. During calendar years 2005 through 2008, the Company recognized favorable re-estimates of both loss and allocated loss adjustment expenses on

workers’ compensation claims, driven, in part, by state regulatory reforms in California and Florida, underwriting actions, and expense reduction initiatives

that had a greater impact in controlling costs than originally estimated. In 2007, the Company released reserves for package business claims as reported losses

emerged favorably to previous expectations. In 2007 through 2009, the Company released reserves for general liability claims due to the favorable emergence of

losses for high hazard and umbrella general liability claims. Reserves for professional liability claims were released in 2008 and 2009 related to the 2003

through 2007 accident years due to a lower estimate of claim severity on both directors’ and officers’ insurance claims and errors and omissions insurance

claims. Reserves of auto liability claims, within Consumer Markets, were released in 2008 due largely to an improvement in emerged claim severity for the

2005 to 2007 accident years.

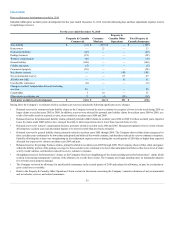

Reserve changes for accident years 2008 through 2009

Accident years 2008 through 2009 remain reasonably close to original estimates. Modest favorable reserve re-estimates during calendar periods 2009 through

2012 are primarily related to liability lines of business.

Reserve changes for accident year 2010

Unfavorable reserve re-estimates in calendar year 2011 are largely driven by workers’ compensation. Loss cost trends were higher than initially expected as an

increase in frequency outpaced a moderation of severity trends.

Reserve changes for accident year 2011

Accident year 2011 remains reasonably close to the original estimate. Modest unfavorable reserve re-estimates during calendar periods 2012 are primarily

related to workers compensation driven by late development of lost time claims.

60