The Hartford 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In addition, certain assets, including a portion of premiums receivable and fixed assets, are non-admitted (recorded at zero value and charged against surplus)

under U.S. STAT. U.S. GAAP generally evaluates assets based on their recoverability.

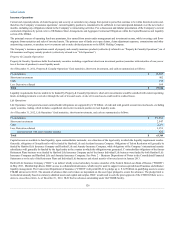

The Hartford's U.S. insurance companies' states of domicile impose risk-based capital (“RBC”) requirements. The requirements provide a means of

measuring the minimum amount of statutory surplus appropriate for an insurance company to support its overall business operations based on its size and

risk profile. Regulatory compliance is determined by a ratio of a company's total adjusted capital (“TAC”) to its authorized control level RBC (“ACL RBC”).

Companies below specific trigger points or ratios are classified within certain levels, each of which requires specified corrective action. The minimum level of

TAC before corrective action commences is two times the ACL RBC (“Company Action Level”). The adequacy of a company's capital is determined by the

ratio of a company's TAC to its Company Action Level (known as the RBC ratio). All of The Hartford's operating insurance subsidiaries had RBC ratios in

excess of the minimum levels required by the applicable insurance regulations.

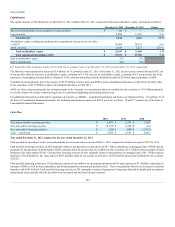

Similar to the RBC ratios that are employed by U.S. insurance regulators, regulatory authorities in the international jurisdictions in which The Hartford

operates generally establish minimum solvency requirements for insurance companies. All of The Hartford's international insurance subsidiaries have

solvency margins in excess of the minimum levels required by the applicable regulatory authorities.

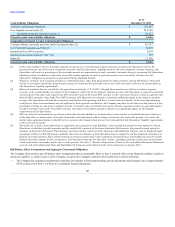

In any particular year, statutory surplus amounts and RBC ratios may increase or decrease depending upon a variety of factors. The amount of change in the

statutory surplus or RBC ratios can vary based on individual factors and may be compounded in extreme scenarios or if multiple factors occur at the same

time. At times the impact of changes in certain market factors or a combination of multiple factors on RBC ratios can be counterintuitive. For further

discussion on these factors and the potential impacts to the life insurance subsidiaries, see the Financial Risk on Statutory Capital section within Enterprise

Risk Management.

Statutory capital at the property and casualty subsidiaries has historically been maintained at or above the capital level required to meet “AA level” ratings

from rating agencies. Statutory capital generated by the property and casualty subsidiaries in excess of the capital level required to meet “AA level” ratings is

available for use by the enterprise or for corporate purposes. The amount of statutory capital can increase or decrease depending on a number of factors

affecting property and casualty results including, among other factors, the level of catastrophe claims incurred, the amount of reserve development, the effect

of changes in interest rates on investment income and the discounting of loss reserves, and the effect of realized gains and losses on investments.

In addition, the Company can access the $500 Glen Meadow trust contingent capital facility and maintains the ability to access $1.75 billion of capacity

under its revolving credit facility.

Contingencies

Legal Proceedings — For a discussion regarding contingencies related to The Hartford’s legal proceedings, please see the information contained under

“Litigation” and “Asbestos and Environmental Claims,” in Note 13 of the Notes to Consolidated Financial Statements, which is incorporated herein by

reference.

For a discussion of terrorism reinsurance legislation and how it affects The Hartford, see “Terrorism” under the Insurance Risk Management section of the

MD&A.

Tax proposals and regulatory initiatives which have been or are being considered by Congress and/or the United States Treasury Department could have a

material effect on the insurance business. These proposals and initiatives include, or could include, new taxes or assessments on large financial institutions,

changes pertaining to the income tax treatment of insurance companies and life insurance products and annuities, repeal or reform of the estate tax and

comprehensive federal tax reform, and changes to the regulatory structure for financial institutions. The nature and timing of any Congressional or regulatory

action with respect to any such efforts is unclear.

132