The Hartford 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

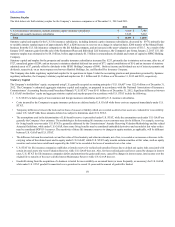

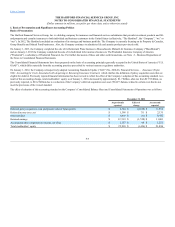

In addition, the Company maintains the 2000 PLANCO Non-employee Option Plan (the “PLANCO Plan”) pursuant to which it granted awards to non-

employee wholesalers of products of Hartford Life Distributors, LLC, and its affiliate, PLANCO, LLC (collectively “HLD”). No awards have been issued

under the PLANCO Plan since 2003, and no future awards are contemplated. The only remaining outstanding awards under the PLANCO Plan expire in

February, 2013.

The Company's Board of Directors adopted the PLANCO Plan on July 20, 2000, and amended it on February 20, 2003 to increase the number of shares of the

Company's common stock subject to the plan to 450,000 shares. The stockholders of the Company have not approved the PLANCO Plan.

Eligibility - Any non-employee independent contractor serving on the wholesale sales force as an insurance agent who was an exclusive agent of the Company

or who derived more than 50% of his or her annual income from the Company was eligible.

Terms of options - Nonqualified stock options (“NQSOs”) to purchase shares of common stock were available for grant under the PLANCO Plan. The

administrator of the PLANCO Plan, the Compensation and Management Development Committee, (i) determined the recipients of options under the PLANCO

Plan, (ii) determined the number of shares of common stock covered by such options, (iii) determined the dates and the manner in which options became

exercisable (which was typically in three equal annual installments beginning on the first anniversary of the date of grant), (iv) set the exercise price of options

(which could be less than, equal to or greater than the fair market value of common stock on the date of grant) and (v) determined the other terms and

conditions of each option. Payment of the exercise price may be made in cash, other shares of the Company's common stock or through a same day sale

program. The term of an NQSO could not exceed ten years and two days from the date of grant.

If an optionee's required relationship with the Company terminates for any reason, other than for cause, any exercisable options remain exercisable for a fixed

period of four months, not to exceed the remainder of the option's term. Any options that are not exercisable at the time of such termination are canceled on the

date of such termination. If the optionee's required relationship is terminated for cause, the options are canceled immediately.

Acceleration in Connection with a Change in Control - Upon the occurrence of a change in control, each option outstanding on the date of such change in

control, and which is not then fully vested and exercisable, shall immediately vest and become exercisable. In general, a “Change in Control” will be deemed to

have occurred upon the acquisition of 40% or more of the outstanding voting stock of the Company, a tender or exchange offer to acquire 15% or more of the

outstanding voting stock of the Company, certain mergers or corporate transactions resulting in the shareholders of the Company before the transactions

owning less than 55% of the entity surviving the transactions, certain transactions involving a transfer of substantially all of the Company's assets or a

change in greater than 50% of the Board members over a two year period.

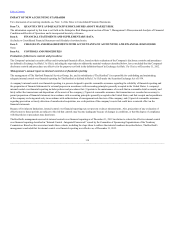

Any information called for by Item 13 will be set forth in the Proxy Statement under the caption “Corporate Governance” and “Board of Directors” and is

incorporated herein by reference.

The information called for by Item 14 will be set forth in the Proxy Statement under the caption “Report of the Audit Committee” and is incorporated herein by

reference.

(a) Documents filed as a part of this report:

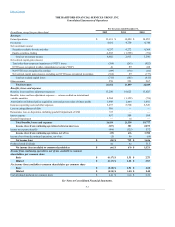

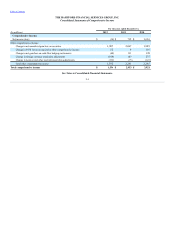

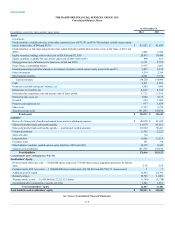

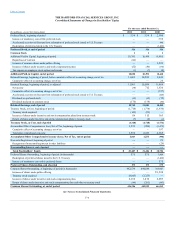

(1) See Index to Consolidated Financial Statements and Schedules elsewhere herein.

(2) See Index to Consolidated Financial Statement and Schedules elsewhere herein.

(3) See Exhibit Index elsewhere herein.

139