The Hartford 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

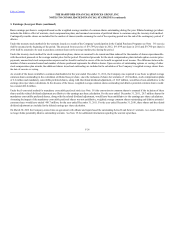

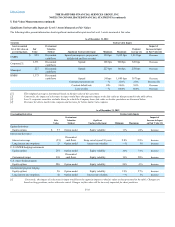

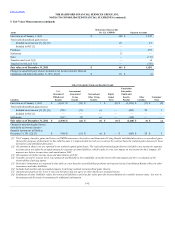

Derivative Instruments, including embedded derivatives within investments

Derivative instruments are fair valued using pricing valuation models that utilize independent market data inputs, quoted market prices for exchange-traded

derivatives, or independent broker quotations. Excluding embedded and reinsurance related derivatives, as of December 31, 2012 and 2011, 97% and 98%,

respectively, of derivatives, based upon notional values, were priced by valuation models or quoted market prices. The remaining derivatives were priced by

broker quotations. The derivatives are valued using mid-market level inputs that are predominantly observable in the market with the exception of the

customized swap contracts that hedge guaranteed minimum withdrawal benefits (“GMWB”) liabilities. Inputs used to value derivatives include, but are not

limited to, swap interest rates, foreign currency forward and spot rates, credit spreads and correlations, interest and equity volatility and equity index levels.

For further discussion, see the Derivative Instruments, including embedded derivatives within the investments section in Note 6 of the Notes to Consolidated

Financial Statements.

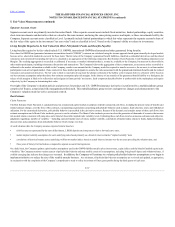

The Company performs various controls on derivative valuations which include both quantitative and qualitative analysis. Analyses are conducted by a

dedicated derivative pricing team that works directly with investment sector professionals to analyze impacts of changes in the market environment and

investigate variances. There is a monthly analysis to identify market value changes greater than pre-defined thresholds, stale prices, missing prices and zero

prices. Also on a monthly basis, a second source validation, typically to broker quotations, is performed for certain of the more complex derivatives, as well

as for all new deals during the month. A model validation review is performed on any new models, which typically includes detailed documentation and

validation to a second source. The model validation documentation and results of validation are presented to the Valuation Committee for approval. There is a

monthly control to review changes in pricing sources to ensure that new models are not moved to production until formally approved.

The Company utilizes derivative instruments to manage the risk associated with certain assets and liabilities. However, the derivative instrument may not be

classified with the same fair value hierarchy level as the associated assets and liabilities. Therefore the realized and unrealized gains and losses on derivatives

reported in Level 3 may not reflect the offsetting impact of the realized and unrealized gains and losses of the associated assets and liabilities.

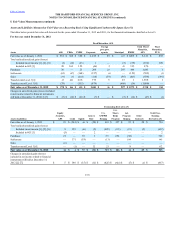

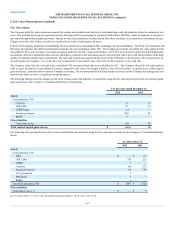

Limited partnerships and other alternative investments

Limited partnerships and other alternative investments include hedge funds where investment company accounting has been applied to a wholly-owned fund

of funds measured at fair value. These funds are fair valued using the net asset value per share or equivalent (“NAV”), as a practical expedient, calculated on

a monthly basis and is the amount at which a unit or shareholder may redeem their investment, if redemption is allowed. Certain impediments to redemption

include, but are not limited to the following: 1) redemption notice may be required and the notice period may be as long as 90 days, 2) redemption may be

restricted (e.g. only be allowed on a quarter-end), 3) a holding period referred to as a lock-up may be imposed whereby an investor must hold their investment

for a specified period of time before they can make a notice for redemption, 4) gating provisions may limit all redemptions in a given period to a percentage of

the entities' equity interests, or may only allow an investor to redeem a portion of their investment at one time and 5) early redemption penalties may be

imposed that are expressed as a percentage of the amount redeemed. The Company will assess impediments to redemption and current market conditions that

will restrict the redemption at the end of the notice period. Any funds that are subject to significant liquidity restrictions are reported in Level 3; all others will

be classified as Level 2.

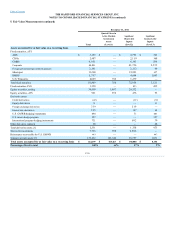

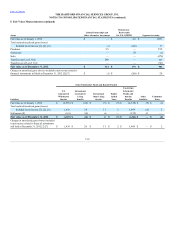

Valuation Techniques and Inputs for Investments

Generally, the Company determines the estimated fair value of its AFS securities, fixed maturities, FVO, equity securities, trading, and short-term investments

using the market approach. The income approach is used for securities priced using a pricing matrix, as well as for derivative instruments. Certain limited

partnerships and other alternative investments are measured at fair value using a NAV as a practical expedient. For Level 1 investments, which are comprised

of on-the-run U.S. Treasuries, exchange-traded equity securities, short-term investments, and exchange traded futures, option and swap contracts, valuations

are based on observable inputs that reflect quoted prices for identical assets in active markets that the Company has the ability to access at the measurement

date.

For most of the Company’s debt securities, the following inputs are typically used in the Company’s pricing methods: reported trades, benchmark yields,

bids and/or estimated cash flows. For securities except U.S. Treasuries, inputs also include issuer spreads, which may consider credit default swaps.

Derivative instruments are valued using mid-market inputs that are predominantly observable in the market.

F-33