The Hartford 2012 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

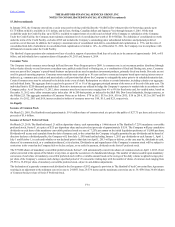

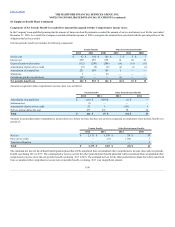

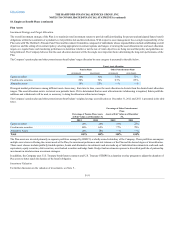

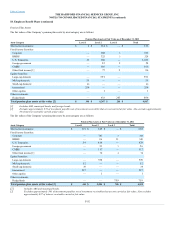

In connection with the Company’s October 17, 2008 investment agreement with Allianz SE, Allianz was issued warrants, with an initial term of seven years,

to purchase the Company’s Series B Non-Voting Contingent Convertible Preferred Stock and Series C Non-Voting Contingent Convertible Preferred Stock,

structured to entitle Allianz, upon receipt of necessary approvals, to purchase 69,115,324 shares of common stock at an initial exercise price of $25.32 per

share.

The warrants were immediately exercisable, pending the receipt of specified regulatory approvals, for the Series B Preferred Stock, which were initially

convertible, in the aggregate, into 34,806,452 shares of common stock.

In addition to the receipt of specified regulatory approvals, the conversion into 34,308,872 shares of common stock of the Series C Preferred Stock underlying

certain of the warrants was subject to the approval of the Company’s stockholders in accordance with applicable regulations of the New York Stock

Exchange. Under the investment agreement, the Company was obligated to pay a cash payment to Allianz if such stockholder approval was not obtained at the

first or second stockholder meetings to consider such approval. Because the conversion of the Series C Preferred Stock was subject to stockholder approval

and the related payment provision represents a form of net cash settlement outside the Company’s control, the warrants to purchase the Series C Preferred

Stock and the stockholder approval payment were recorded as a derivative liability at issuance.

On March 26, 2009, the Company’s shareholders approved the conversion of the Series C Preferred Stock. As a result of this shareholder approval, the

Company was not obligated to pay Allianz any cash payment related to these warrants and therefore these warrants no longer provide for any form of net cash

settlement outside the Company’s control. As such, the warrants to purchase the Series C Preferred Stock were reclassified from other liabilities to equity at

their fair value. As of March 26, 2009, the fair value of these warrants was $93. For the year ended December 31, 2009, the Company recognized a gain of

$70, representing the change in fair value of the warrants through March 26, 2009.

The discretionary equity issuance program that the Company announced on June12, 2009 triggered an anti-dilution provision in the investment agreement

with Allianz, which resulted in an adjustment of the warrant exercise price to $25.25 from 25.32 and to the number of shares that may be purchased to

69,314,987 from 69,115,324. The exercise price under the warrants is subject to adjustment in certain circumstances.

The issuance of warrants to the U.S. Department of the Treasury triggered a contingency payment in the investment agreement related to additional investors.

Upon receipt of preliminary approval to participate in the Capital Purchase Program, The Hartford negotiated with Allianz to modify the form of the

contingency payment. The settlement of the contingency payment was negotiated to allow Allianz a one-time extension of the exercise period of its outstanding

warrants from seven to ten years and a $200 cash payment on October 15, 2009. The Hartford recorded a liability for the cash payment and an adjustment to

additional paid-in capital for the warrant modification resulting in a net realized capital loss of approximately $300 for the year ended December 31, 2009.

Additionally, the issuance of common and preferred stock during the first quarter of 2010 triggered an anti-dilution provision in investment agreement with

Allianz, which resulted in an adjustment to the warrant exercise price to $25.23 from $25.25 and to the number of shares that may be purchased to

69,351,806 from 69,314,987.

On March 30, 2012 the Company repurchased all of the outstanding Series B and Series C warrants held by Allianz for $300. These warrants authorized

Allianz to purchase 69,351,806 shares of the Company’s common stock at an exercise price of $25.23 per share. The repurchase was settled on April 17,

2012.

F-82