The Hartford 2012 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

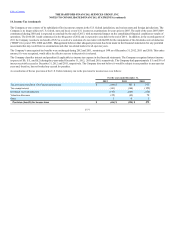

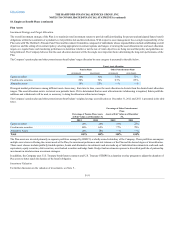

On June 26, 2009, as part of the Capital Purchase Program (“CPP”) established by the U.S. Department of the Treasury (“Treasury”) under the Emergency

Economic Stabilization Act of 2008 (the “EESA”), the Company entered into a Private Placement Purchase Agreement with Treasury pursuant to which the

Company issued and sold to Treasury 3,400,000 shares of the Company’s Fixed Rate Cumulative Perpetual Preferred Stock, Series E, having a liquidation

preference of $1,000 per share (the “Series E Preferred Stock”), and a ten-year warrant to purchase up to 52,093,973 shares of the Company’s common

stock, par value $0.01 per share, at an exercise price of $9.79 per share, for an aggregate purchase price of $3.4 billion.

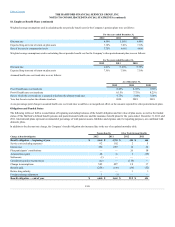

Cumulative dividends on the Series E Preferred Stock accrued on the liquidation preference at a rate of 5% per annum. The Series E Preferred Stock had no

maturity date and ranked senior to the Company’s common stock. The Series E Preferred Stock was non-voting.

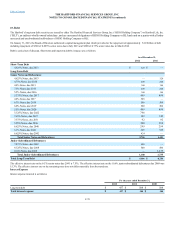

Upon issuance, the fair values of the Series E Preferred Stock and the associated warrants were computed as if the instruments were issued on a stand alone

basis. The fair value of the Series E Preferred stock was estimated based on a five-year holding period and cash flows discounted at a rate of 13% resulting in

a fair value estimate of approximately $2.5 billion. The Company used a Black-Scholes options pricing model including an adjustment for American-style

options to estimate the fair value of the warrants, resulting in a stand alone fair value of approximately $400. The most significant and unobservable

assumption in this valuation was the Company’s share price volatility. The Company used a long-term realized volatility of the Company’s stock of 62%. In

addition, the Company assumed a dividend yield of 1.72%.

The individual fair values were then used to record the Preferred Stock and associated warrants on a relative fair value basis of $2.9 billion and $480,

respectively. The warrants of $480 were recorded to additional paid-in capital as permanent equity. The preferred stock amount was recorded at the liquidation

value of $1,000 per share or $3.4 billion , net of discount of $480. The discount was amortized from the date of issuance, using the effective yield method and

recorded as a direct reduction to retained earnings and deducted from income available to common stockholders in the calculation of earnings per share. The

amortization of discount totaled $40 for the year ended December 31, 2009.

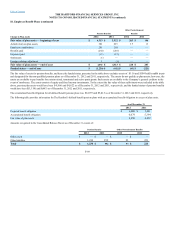

On March 31, 2010, the Company repurchased all 3.4 million shares of Series E preferred stock issued to the Treasury for an aggregate purchase price of $3.4

billion and made a final dividend payment of $22 on the Series E preferred stock. The Company recorded a $440 charge to retained earnings representing the

acceleration of the accretion of the remaining discount on the Series E preferred stock.

On September 27, 2010, the Treasury sold its warrants to purchase approximately 52 million shares of The Hartford’s common stock in a secondary public

offering for net proceeds of approximately $706. The Hartford did not receive any proceeds from this sale. The warrants are exercisable, in whole or in part, at

any time and from time to time until June 26, 2019 at an initial exercise price of $9.79. The exercise price will be paid by the withholding by The Hartford of

a number of shares of common stock issuable upon exercise of the warrants equal to the value of the aggregate exercise price of the warrants so exercised

determined by reference to the closing price of The Hartford’s common stock on the trading day on which the warrants are exercised and notice is delivered to

the warrant agent. The Hartford did not purchase any of the warrants sold by the Treasury.

Subsequently, the declaration of common stock dividends of $0.40 per share during each of the years ended December 31, 2012 and 2011 triggered a

provision in The Hartford’s Warrant Agreement with The Bank of New York Mellon, resulting in adjustments to the warrant exercise price. The warrant

exercise price was $9.599 and $9.699 at December 31, 2012 and 2011, respectively.

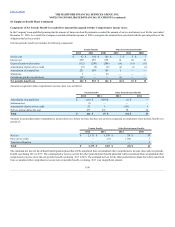

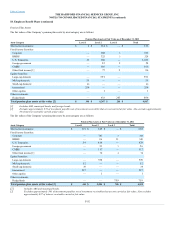

During the year ended December 31, 2012, the Company completed a $500 equity repurchase program authorized on July 27, 2011 by the Board of Directors

that permitted for purchases of common stock, as well as warrants and other derivative securities. In addition to repurchases that occurred in 2011, the

repurchases in 2012 included 8.0 million common shares for $149, and the repurchase of all outstanding Series B and Series C warrants held by Allianz for

$300.

On January 31, 2013, the Board of Directors authorized a capital management plan which provides for a $500 equity repurchase program to be completed by

December 31, 2014.

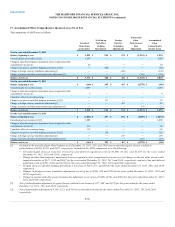

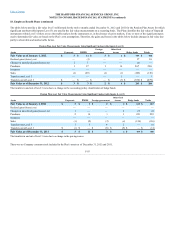

Noncontrolling interest includes VIEs in which the Company has concluded that it is the primary beneficiary, see Note 6 for further discussion of the

Company’s involvement in VIEs, and general account mutual funds where the Company holds the majority interest due to seed money investments.

In 2010, the Company recognized the noncontrolling interest in these entities in other liabilities since these entities represent investment vehicles whereby the

noncontrolling interests may redeem these investments at any time.

F-83