The Hartford 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335

|

|

Table of Contents

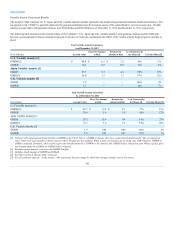

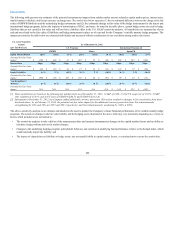

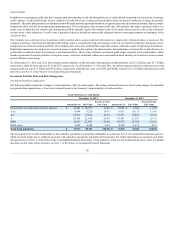

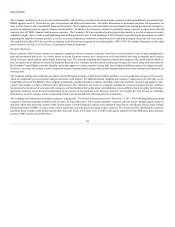

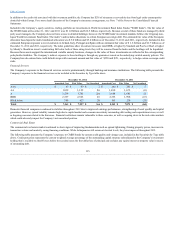

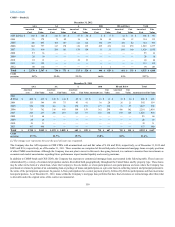

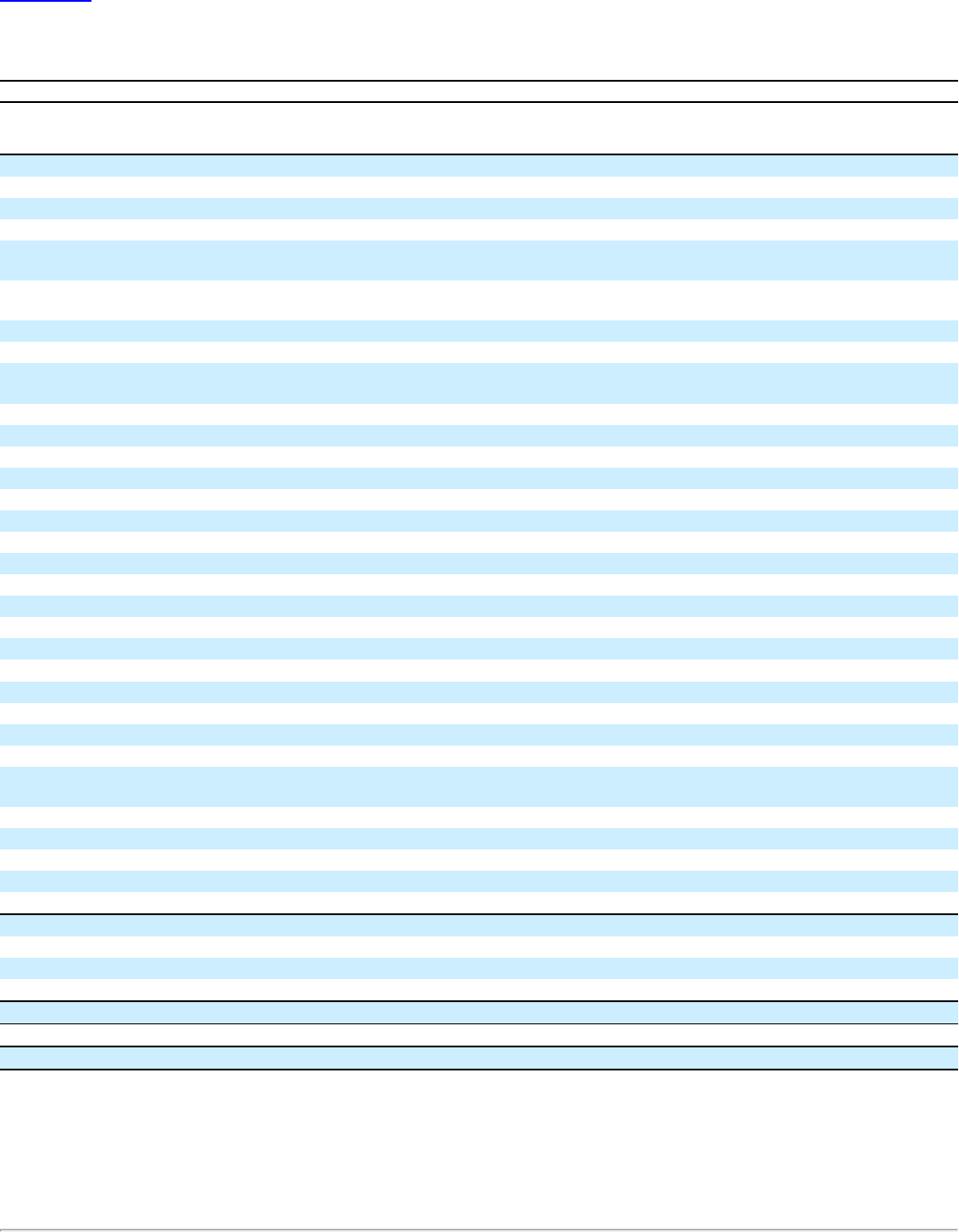

The following table presents the Company’s AFS securities by type, as well as fixed maturities, FVO.

Asset-backed securities (“ABS”)

Consumer loans $2,234 $29 $(116) $ 2,147 2.5%$2,688 $34 $(208) $ 2,514 3.1%

Small business 336 7 (67) 276 0.3%418 1(123)296 0.4%

Other 313 27 — 340 0.4%324 20 (1)343 0.4%

Collateralized debt obligations

("CDOs")

Collateralized loan obligations

(“CLOs”) 2,197 — (68) 2,129 2.5%2,334 —(181)2,153 2.6%

Commercial real estate ("CREs") 420 44 (80)384 0.4%485 16 (167) 334 0.4%

Other [1] 553 16 (11)527 0.6%— — — — —%

Commercial mortgage-backed

securities ("CMBS")

Agency backed [2] 962 79 —1,041 1.2%637 40 —677 0.8%

Bonds 4,535 293 (160)4,668 5.4%5,992 182 (487)5,687 7.0%

Interest only (“IOs”) 586 45 (19) 612 0.7%563 49 (25) 587 0.7%

Corporate

Basic industry [1] 3,741 369 (6) 4,104 4.8%3,690 309 (19) 3,979 4.9%

Capital goods 3,109 389 (2)3,496 4.1%3,327 331 (33)3,625 4.4%

Consumer cyclical 2,423 266 (5) 2,684 3.1%2,277 206 (8)2,475 3.0%

Consumer non-cyclical 5,927 759 (7)6,679 7.8%5,985 644 (13)6,616 8.1%

Energy 3,816 499 (3)4,312 5.0%3,338 381 (15) 3,704 4.5%

Financial services 7,230 604 (211)7,623 8.9%7,763 334 (526)7,571 9.3%

Tech./comm. 3,971 526 (16) 4,481 5.2%4,357 443 (61) 4,739 5.8%

Transportation 1,393 163 (2)1,554 1.8%1,285 123 (6) 1,402 1.7%

Utilities 7,792 1,017 (24)8,785 10.2%8,236 857 (38)9,055 11.2%

Other [1] 292 39 — 331 0.4%903 33 (20) 845 1.0%

Foreign govt./govt. agencies 3,985 191 (40) 4,136 4.8%2,030 141 (10)2,161 2.6%

Municipal Taxable 2,235 246 (15) 2,466 2.9%1,688 120 (51) 1,757 2.1%

Tax-exempt 10,766 1,133 (4)11,895 13.9%10,869 655 (21)11,503 14.1%

Residential mortgage-backed

securities ("RMBS")

Agency 5,906 259 (3)6,162 7.2%4,436 222 — 4,658 5.7%

Non-agency — — — — —%62 —(2) 60 0.1%

Alt-A 38 —(1)37 —%115 5(21)99 0.1%

Sub-prime 1,374 36 (129) 1,281 1.5%1,348 25 (433)940 1.1%

U.S. Treasuries 3,613 175 (16) 3,772 4.4%3,828 203 (2) 4,029 4.9%

Equity securities

Financial services 331 15 (42)304

479 10 (187)302

Other 535 66 (15) 586

577 58 (16) 619

[1] Gross unrealized gains (losses) exclude the fair value of bifurcated embedded derivative features of certain securities. Changes in value are recorded in

net realized capital gains (losses).

[2] Includes securities with pools of loans issued by the Small Business Administration which are backed by the full faith and credit of the U.S.

government.

[3] Includes investments relating to the sales of the Retirement Plans and Individual Life businesses; see Note 2 - Business Dispositions of the Notes to the

Consolidated Financial Statements for further discussion of this transaction.

112