Shaw 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

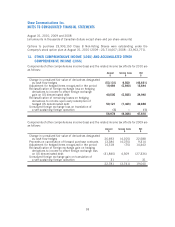

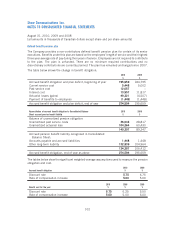

Components of other comprehensive income (loss) and the related income tax effects for 2008 are

as follows:

Amount

$

Income taxes

$

Net

$

Change in unrealized fair value of derivatives designated

as cash flow hedges (43,327) 7,134 (36,193)

Adjustment for hedged items recognized in the period 49,801 (9,578) 40,223

Reclassification of foreign exchange gain on hedging

derivatives to income to offset foreign exchange loss

on US denominated debt (5,597) 801 (4,796)

Unrealized foreign exchange gain on translation of

a self-sustaining foreign operation 7 – 7

884 (1,643) (759)

Accumulated other comprehensive income (loss) is comprised of the following:

August 31, 2010

$

August 31, 2009

$

Unrealized foreign exchange gain on translation of

a self-sustaining foreign operation 349 350

Fair value of derivatives 8,627 (38,984)

8,976 (38,634)

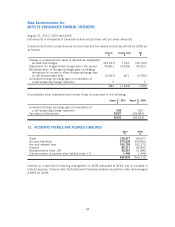

13. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

2010

$

2009

$

Trade 125,517 86,677

Accrued liabilities 274,334 269,463

Accrued network fees 100,703 103,176

Interest 85,211 80,463

Related parties [note 18] 35,857 21,883

Current portion of pension plan liability [note 17] 1,448 1,448

623,070 563,110

Interest on a short-term financing arrangement in 2008 amounted to $744 and is included in

interest expense. Interest rates fluctuated with Canadian bankers acceptance rates and averaged

4.89% for 2008.

94

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]