Shaw 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Use of estimates and measurement uncertainty

The preparation of consolidated financial statements in conformity with Canadian GAAP requires

management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial

statements and the reported amounts of revenues and expenses during the year. Actual results

could differ from those estimates.

Key areas of estimation, where management has made difficult, complex or subjective judgments,

often as a result of matters that are inherently uncertain, are the allowance for doubtful accounts,

the ability to use income tax loss carryforwards and other future income tax assets, capitalization of

labour and overhead, useful lives of depreciable assets, contingent liabilities, certain assumptions

used in determining defined benefit plan pension expense and the recoverability of deferred costs,

broadcast rights, spectrum licenses and goodwill using estimated future cash flows. Significant

changes in assumptions could result in impairment of intangible assets.

Adoption of recent Canadian accounting pronouncements

(i) Goodwill and intangible assets

Effective September 1, 2009, the Company adopted CICA Handbook Section 3064, “Goodwill and

Intangible Assets”, which replaces Sections 3062, “Goodwill and Other Intangible Assets”, and

3450, “Research and Development Costs”. Section 3064 establishes standards for the

recognition, measurement, presentation and disclosure of goodwill and intangible assets. As a

result, connection costs that had been previously deferred and amortized, no longer meet the

recognition criteria for intangible assets. In addition, the new standard requires computer software,

that is not an integral part of the related hardware, to be classified as an intangible asset.

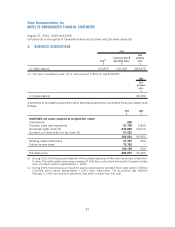

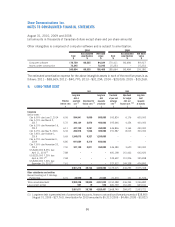

The provisions of Section 3064 were adopted retrospectively with restatement of prior periods. The

impact on the Consolidated Balance Sheets as at August 31, 2010 and August 31, 2009 and on the

Consolidated Statements of Income and Retained Earnings (Deficit) for the year ended August 31,

2010, 2009 and 2008 is as follows:

August 31, 2010

$

August 31, 2009

$

Increase (decrease)

Consolidated balance sheets:

Property, plant and equipment (156,469) (105,180)

Deferred charges (4,266) (3,383)

Intangibles 156,469 105,180

Future income taxes (1,077) (863)

Retained earnings (3,189) (2,520)

Decrease in retained earnings:

Adjustment for change in accounting policy (2,520) (3,756)

Increase (decrease) in net income (669) 1,236

(3,189) (2,520)

79

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]