Shaw 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

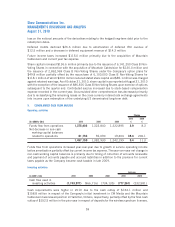

lower contribution resulting from the economic impact on Shaw Tracking. Compared to the prior year,

Satellite service operating income before amortization was up 5.6% to $269.3 million.

Total capital investment of $81.5 million during 2009 was comparable to the 2008 year spend of

$78.1 million, respectively. The increase in Transponder and other in 2009 was mainly due to the

relocation and expansion of the Montreal call centre.

During 2009 Shaw Direct added 12 HD channels and its HD customer base increased to almost

325,000 at August 31, 2009.

WIRELESS

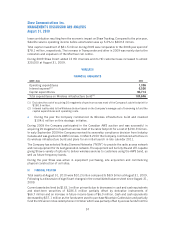

FINANCIAL HIGHLIGHTS

($000’s Cdn) 2010

Operating expenditures 1,396

Interest expense

(2)

6,536

Capital expenditures 96,714

Total expenditures on Wireless infrastructure build

(1)

104,646

(1) Excludes the cost of acquiring 20 megahertz of spectrum across most of the Company’s cable footprint for

$190.9 million.

(2) Interest is allocated to the Wireless division based on the Company’s average cost of borrowing to fund the

capital expenditures and operating costs.

kDuring the year the Company commenced its Wireless infrastructure build and invested

$104.6 million on this strategic initiative.

During 2008 the Company participated in the Canadian AWS auction and was successful in

acquiring 20 megahertz of spectrum across most of its cable footprint for a cost of $190.9 million.

In early September 2009 the Company received its ownership compliance decision from Industry

Canada and was granted its AWS licenses. In March 2010 the Company commenced activities on

its wireless infrastructure build and plans for an initial launch in late calendar 2011.

The Company has selected Nokia Siemens Networks (“NSN”) to provide the radio access network

and core equipment for its next generation network. The equipment will be fully 3G and LTE capable

giving Shaw a variety of options to deliver wireless services to customers using the AWS band, as

well as future frequency bands.

During the year Shaw was active in equipment purchasing, site acquisition and commencing

physical construction of cell sites.

IV. FINANCIAL POSITION

Total assets at August 31, 2010 were $10.2 billion compared to $8.9 billion at August 31, 2009.

Following is a discussion of significant changes in the consolidated balance sheet since August 31,

2009.

Current assets declined by $162.1 million primarily due to decreases in cash and cash equivalents

and short-term securities of $236.5 million partially offset by derivative instruments of

$66.7 million and an increase in future income taxes of $6.0 million. Cash and cash equivalents

decreased by $37.1 million as the funds were used to purchase Mountain Cablevision and partially

fund the US senior notes redemptions in October which was partially offset by excess funds from the

57

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010