Shaw 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

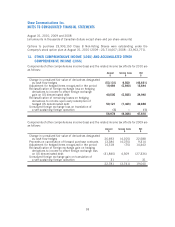

15. BUSINESS SEGMENT INFORMATION

The Company’s operating segments are Cable, Wireless, DTH and Satellite Services, all of which are

substantially located in Canada. During the current year, the Company commenced its initial

wireless activities and began reporting this new business as a separate operating unit. Accordingly,

deposits on AWS spectrum licenses as at August 31, 2009 and 2008 have been reclassified from

corporate assets to the Wireless segment. All of these operations are substantially located in

Canada. The accounting policies of the segments are the same as those described in the summary of

significant accounting policies. Management evaluates divisional performance based on service

revenue and service operating income before charges such as amortization.

Cable

$

Wireless

$

DTH

$

Satellite Services

$

Total

$

Total

$

Satellite

2010

Service revenue – total 2,931,976 – 721,952 82,600 804,552 3,736,528

Intersegment (4,565) – (10,883) (3,500) (14,383) (18,948)

2,927,411 – 711,069 79,100 790,169 3,717,580

Service operating income (expenditures) before

amortization

(6)

1,456,827 (1,396) 265,016 38,304 303,320 1,758,751

Service operating income as % of external revenue 49.8% – 37.3% 48.4% 38.4% 47.3%

Interest

(1)

213,898 6,536 n/a n/a 26,251 246,685

Burrard Landing Lot 2 Holdings Partnership 1,326

248,011

Cash taxes

(2)

136,000 – n/a n/a 44,000 180,000

Corporate/other (12,233)

167,767

Segment assets 7,111,526 287,626 844,502 483,404 1,327,906 8,727,058

Corporate assets 1,426,907

Total assets 10,153,965

Capital expenditures and equipment costs (net)

by segment

Capital expenditures 739,136 96,714 3,139 2,113 5,252 841,102

Equipment costs (net) 17,949 – 80,359 – 80,359 98,308

757,085 96,714 83,498 2,113 85,611 939,410

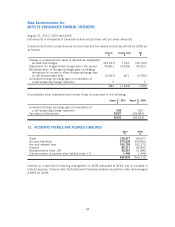

Reconciliation to Consolidated Statements of Cash Flows

Additions to property, plant and equipment 681,589

Additions to equipment costs (net) 98,308

Additions to other intangibles 60,785

Total of capital expenditures and equipment costs

(net) per Consolidated Statements of Cash Flows 840,682

Increase in working capital related to capital

expenditures 102,232

Less: Proceeds on disposal of property, plant and

equipment (430)

Less: Satellite services equipment profit

(4)

(3,040)

Less: Partnership capital expenditures

(5)

(34)

Total capital expenditures and equipment costs (net)

reported by segments 939,410

See notes following 2008 business segment table.

97

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]