Shaw 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

xi) Dividend payments

The Company currently pays monthly dividends in amounts approved on a quarterly basis by the

Board of Directors. At the current approved dividend amount, the Company would pay

approximately $380.0 million in dividends during 2011. While the Company expects to generate

sufficient free cash flow in 2011 to fund these dividend payments, if actual results are different

from expectations there can be no assurance that the Company will continue dividend payments at

the current level.

xii) Acquisitions and other strategic transactions

The Company may from time to time make acquisitions and enter into other strategic transactions.

In connection with these acquisitions and strategic transactions, Shaw may fail to realize the

anticipated benefits, incur unanticipated expenses and/or have difficulty incorporating or

integrating the acquired business, the occurrence of which could have a material adverse effect

on the Company.

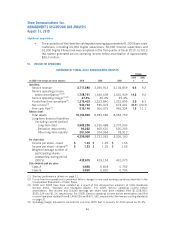

II. SUMMARY OF QUARTERLY RESULTS

(In $000’s Cdn except per share amounts)

Quarter

Service

revenue

Service

operating income

before

amortization

(1)(4)

Net income

(4)

Basic

earnings

per share

(2)(4)

Funds flow

from

operations

(3)

2010

Fourth 938,872 423,152 121,575 0.28 327,435

Third 943,632 435,822 158,216 0.37 350,810

Second 929,142 424,825 138,712 0.32 358,206

First 905,934 474,952 114,229 0.26 338,952

Total 3,717,580 1,758,751 532,732 1.23 1,375,403

2009

Fourth 872,919 394,900 124,265 0.29 321,319

Third 861,382 395,547 132,151 0.31 356,046

Second 839,144 381,832 156,585 0.37 334,508

First 817,468 368,330 123,474 0.29 311,967

Total 3,390,913 1,540,609 536,475 1.25 1,323,840

(1) See key performance drivers on page 21.

(2) Diluted earnings per share equals basic earnings per share except for the second quarter of 2009 where

diluted earnings per share is $0.36.

(3) Funds flow from operations is presented before changes in net non-cash working capital as presented in

the Consolidated Statement of Cash Flows.

(4) 2009 is restated for the retrospective adoption of CICA Handbook Section 3064, “Goodwill and

Intangible Assets”. See new accounting standards on page 31.

44

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010