Shaw 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

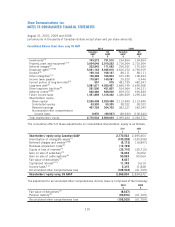

Level 2 Inputs for the asset or liability are based on observable market data, either directly or

indirectly, other than quoted prices.

Level 3 Inputs for the asset or liability that are not based on observable market data.

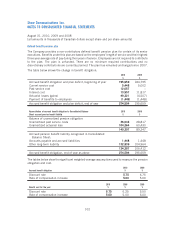

The following tables represent the Company’s derivative instruments measured at fair value on a

recurring basis and the basis for that measurement:

Carrying

value

$

Quoted prices in

active markets for

identical instrument

(Level 1)

$

Significant other

observable inputs

(Level 2)

$

Significant

unobservable inputs

(Level 3)

$

August 31, 2010

Assets

Cross-currency interest rate

exchange agreement 56,716 – 56,716 –

US currency forward purchase

contracts 10,002 – 10,002 –

66,718 – 66,718 –

Liabilities

Cross-currency interest rate

exchange agreements 86,222 – 86,222 –

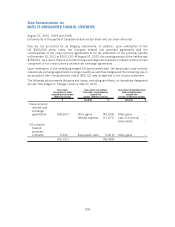

Carrying

value

$

Quoted prices in

active markets for

identical instrument

(Level 1)

$

Significant other

observable inputs

(Level 2)

$

Significant

unobservable inputs

(Level 3)

$

August 31, 2009

Liabilities

Cross-currency interest rate

exchange agreements 462,273 – 462,273 –

US currency forward purchase

contracts 3,337 – 3,337 –

465,610 – 465,610 –

Derivative instruments and hedging activities

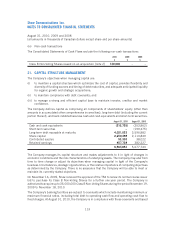

During the year, the Company redeemed all of its outstanding US $440,000 8.25% senior notes

due April 11, 2010, US $225,000 7.25% senior notes due April 6, 2011 and US $300,000

7.20% senior notes due December 15, 2011. In conjunction with the redemption of the

US $440,000 and US $225,000 senior notes, the Company paid $146,065 to unwind and settle

a portion of the principal component of two of the associated cross-currency interest rate swaps and

simultaneously entered into offsetting currency swap transactions for the remaining outstanding

notional principal amounts (i.e. the end of swap notional exchanges) and paid $145,855 in respect

of these offsetting swap transactions. The derivatives have been classified as held for trading as

107

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]