Shaw 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the period leading up to the changeover, the AcSB will continue to issue accounting standards

that are converged with IFRS, thus mitigating the impact of the adoption of IFRS at the changeover

date. The IASB will also continue to issue new accounting standards during the conversion period

and, as a result, the final impact of IFRS on the Company’s consolidated financial statements will

only be measured once all IFRS applicable at the conversion date are known.

The Company’s adoption of IFRS will require the application of IFRS 1, First-Time Adoption of

International Financial Reporting Standards (“IFRS 1”), which provides guidance for an entity’s

initial adoption of IFRS. IFRS 1 generally requires that an entity apply all IFRS effective at the end

of its first IFRS reporting period retrospectively. However, IFRS 1 does include certain mandatory

exceptions and limited optional exemptions in specified areas of certain standards from this general

requirement. Management is assessing the exemptions available under IFRS 1 and their impact on

the Company’s future financial position. On adoption of IFRS, the significant optional exemptions

being considered by the Company are as follows:

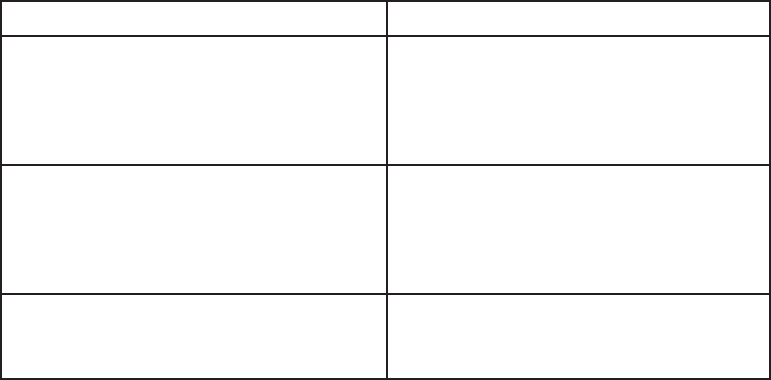

Exemption Application of exemption

Business combinations The Company expects to apply IFRS 3

prospectively from its transition date and

elect not to restate any business

combinations that occurred prior to

September 1, 2010.

Employee benefits The Company expects to elect to recognize

cumulative actuarial gains and losses

arising from all of its defined benefit

plans as at September 1, 2010 in

opening retained earnings.

Borrowing costs The Company expects to elect to apply IAS

23 “Borrowing Costs” prospectively from

September 1, 2010.

Management is in the process of quantifying the expected material differences between IFRS and

the current accounting treatment under Canadian GAAP. Set out below are the key areas where

changes in accounting policies are expected that may impact the Company’s consolidated financial

statements. The list and comments should not be regarded as a complete list of changes that will

result from the transition to IFRS. It is intended to highlight those areas management believes to be

most significant. However, the IASB has significant ongoing projects that could affect the ultimate

differences between Canadian GAAP and IFRS and their impact on the Company’s consolidated

financial statements. Consequently, management’s analysis of changes and policy decisions have

been made based on its expectations regarding the accounting standards that we anticipate will be

effective at the time of transition. The future impacts of IFRS will also depend on the particular

circumstances prevailing in those years. At this stage, management is not able to reliably quantify

the impacts expected on the Company’s consolidated financial statements for these differences.

Please see the section entitled “Cautionary statement regarding forward-looking statements”.

The following differences between Canadian GAAP and IFRS have been identified that are expected

to impact the Company’s financial statements. This is not an exhaustive list of all of the changes

that could occur during the transition to IFRS. At this time, the comprehensive impact of the

changeover on the Company’s future financial position and results of operations is not yet

34

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010