Shaw 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

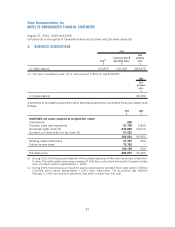

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]

1. SIGNIFICANT ACCOUNTING POLICIES

Shaw Communications Inc. (the “Company”) is a public company whose shares are listed on the

Toronto and New York Stock Exchanges. The Company is a diversified Canadian communications

company whose core operating business is providing broadband cable television services, Internet,

Digital Phone, and telecommunications services (“Cable”); Direct-to-home (“DTH”) satellite

services (Shaw Direct) and satellite distribution services (“Satellite Services”); and programming

content (through Shaw Media). During the current year, the Company commenced its initial wireless

activities and began reporting this new business as a separate reporting unit.

The consolidated financial statements are prepared by management in accordance with Canadian

generally accepted accounting principles (“GAAP”). The effects of differences between the

application of Canadian and US GAAP on the consolidated financial statements of the Company

are described in note 22.

Basis of consolidation

The consolidated financial statements include the accounts of the Company and those of its

subsidiaries. Intercompany transactions and balances are eliminated on consolidation. The results

of operations of subsidiaries acquired during the year are included from their respective dates of

acquisition.

The accounts also include the Company’s 33.33% proportionate share of the assets, liabilities,

revenues, and expenses of its interest in the Burrard Landing Lot 2 Holdings Partnership (the

“Partnership”).

The Company’s interest in the Partnership’s assets, liabilities, results of operations and cash flows

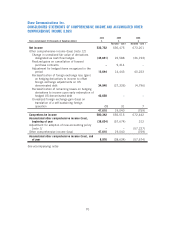

are as follows:

2010

$

2009

$

Working capital 180 369

Property, plant and equipment 16,820 17,451

17,000 17,820

Debt 20,951 21,473

Proportionate share of net liabilities (3,951) (3,653)

2010

$

2009

$

2008

$

Operating, general and administrative expenses 1,829 1,829 1,829

Amortization (683) (688) (707)

Interest (1,326) (1,358) (1,389)

Other gains 867 879 848

Proportionate share of income before income taxes 687 662 581

Cash flow provided by operating activities 1,560 1,326 1,608

Cash flow used in investing activities (34) ––

Cash flow used in financing activities (541) (509) (478)

Proportionate share of increase in cash 985 817 1,130

72