Shaw 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

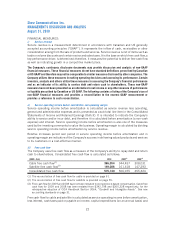

The provisions of Section 3064 were adopted retrospectively with restatement of prior periods. The

impact on the Consolidated Balance Sheets as at August 31, 2010 and August 31, 2009 and on the

Consolidated Statements of Income and Retained Earnings (Deficit) for the year ended August 31,

2010, 2009 and 2008 is as follows:

August 31, 2010

$

August 31, 2009

$

Increase (decrease)

Consolidated balance sheets:

Property, plant and equipment (156,469) (105,180)

Deferred charges (4,266) (3,383)

Intangibles 156,469 105,180

Future income taxes (1,077) (863)

Retained earnings (3,189) (2,520)

Decrease in retained earnings:

Adjustment for change in accounting policy (2,520) (3,756)

Increase (decrease) in net income (669) 1,236

(3,189) (2,520)

2010 2009 2008

Year ended August 31,

$$ $

Consolidated statements of income:

Decrease (increase) in operating, general and

administrative expenses (883) 1,659 2,693

Decrease in amortization of property, plant and equipment 33,285 30,774 23,954

Increase in amortization of other intangibles (33,285) (30,774) (23,954)

Decrease (increase) in income tax expense 214 (423) (1,054)

Increase (decrease) in net income and comprehensive

income (669) 1,236 1,639

Increase (decrease) in earnings per share –––

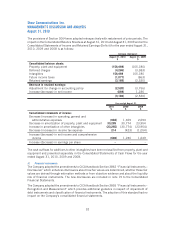

The cash outflows for additions to other intangibles have been reclassified from property, plant and

equipment and presented separately in the Consolidated Statements of Cash Flows for the year

ended August 31, 2010, 2009 and 2008.

ii) Financial instruments

The Company adopted the amendments to CICA Handbook Section 3862 “Financial Instruments –

Disclosures” which enhances disclosures about how fair values are determined, whether those fair

values are derived through estimation methods or from objective evidence and about the liquidity

risk of financial instruments. The new disclosures are included in note 19 to the Consolidated

Financial Statements.

The Company adopted the amendments to CICA Handbook Section 3855 “Financial Instruments –

Recognition and Measurement” which provides additional guidance in respect of impairment of

debt instruments and classification of financial instruments. The adoption of this standard had no

impact on the Company’s consolidated financial statements.

32

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010