Shaw 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

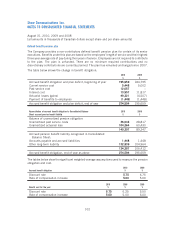

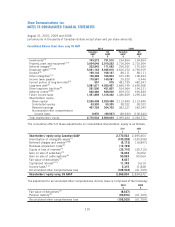

The following table presents the gains and losses, excluding tax effects, on derivatives designated

as cash flow hedges to manage currency risks for 2009.

$ Location $ Location $

Gain (loss)

recognized in other

comprehensive income

(effective portion)

Gain (loss) reclassified

from other comprehensive

income into

income (effective portion)

Gain (loss) reclassified from

other comprehensive

income into

income (ineffective portion)

Cross-currency

interest rate

exchange

agreements 24,799 Other gains 31,845 Other gains –

Interest expense (26,313) Loss on financial

instruments –

US currency

forward

purchase

contracts 15,278 Equipment costs 11,795 Other gains –

40,077 17,327 –

The Company’s estimate of the net amount of existing gains or losses arising from the unrealized fair

value of derivatives designated as cash flow hedges which are reported in accumulated other

comprehensive income and would be reclassified to net income in the next twelve months,

excluding tax effects, is a gain of $10,002 for foreign exchange forwards based on contractual

maturities.

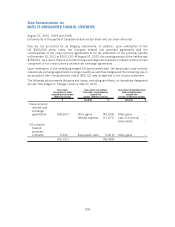

The following table presents gains and losses, excluding tax effects, arising from derivatives that

were not designated as hedges.

Location

2010

$

2009

$

Gain (loss)

recognized in

income

Cross-currency interest rate exchange agreements Loss on financial

instruments 4,958 –

US currency forward purchase contracts Other gains –(78)

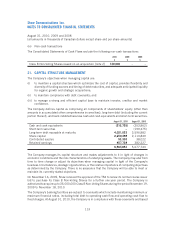

Risk management

The Company is exposed to various market risks including currency risk and interest rate risk, as

well as credit risk and liquidity risk associated with financial assets and liabilities. The Company

has designed and implemented various risk management strategies, discussed further below, to

ensure the exposure to these risks is consistent with its risk tolerance and business objectives.

Currency risk

As the Company has grown it has accessed US capital markets for a portion of its borrowings. Since

the Company’s revenues and assets are primarily denominated in Canadian dollars, it faced

significant potential foreign exchange risks in respect of the servicing of the interest and principal

109

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]