Shaw 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

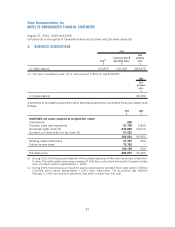

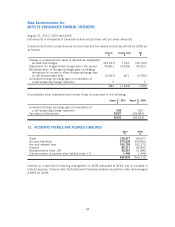

Other intangibles is comprised of computer software and is subject to amortization.

Cost

$

Accumulated

amortization

$

Net book

value

$

Cost

$

Accumulated

amortization

$

Net book

value

$

2010 2009

Computer software 170,759 86,535 84,224 170,411 80,484 89,927

Assets under construction 72,245 – 72,245 15,253 – 15,253

243,004 86,535 156,469 185,664 80,484 105,180

The estimated amortization expense for the above intangible assets in each of the next five years is as

follows: 2011 – $38,669; 2012 – $40,770; 2013 – $31,294; 2014 – $20,039; 2015 – $15,268.

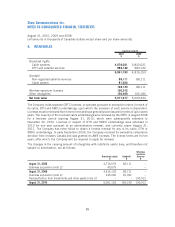

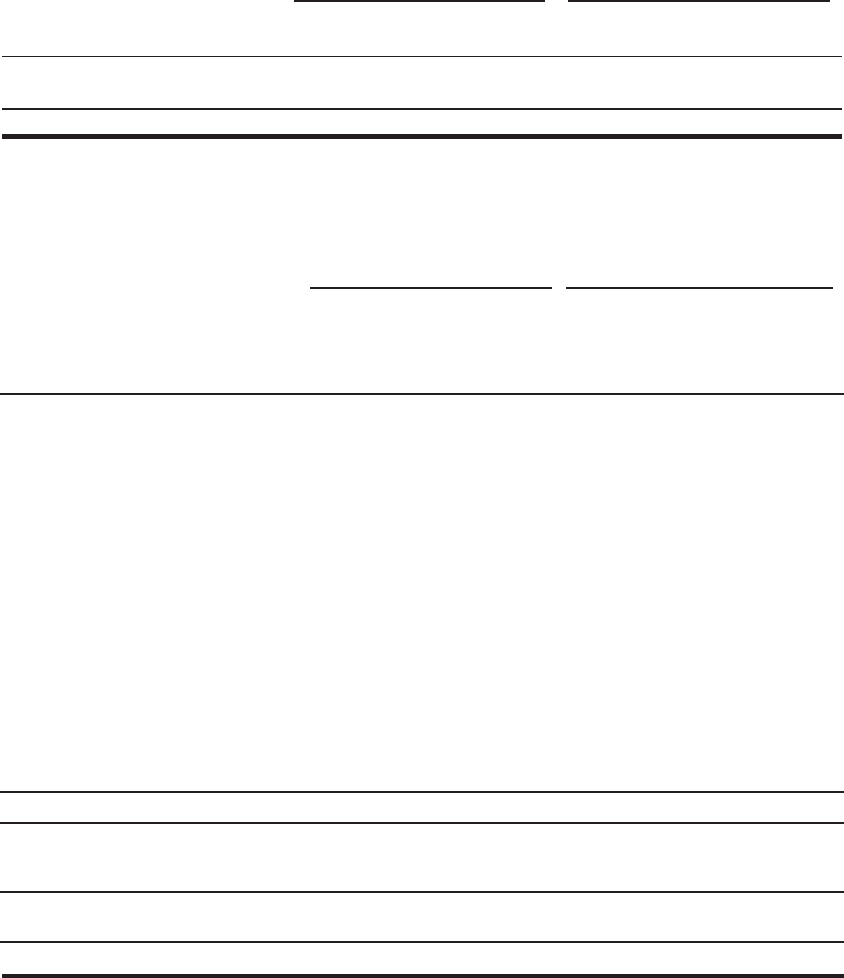

9. LONG-TERM DEBT

Effective

interest rates

%

Long-term

debt at

amortized

cost

(1)

$

Adjustment for

finance costs

(1)

$

Long-term

debt

repayable

at maturity

$

Translated

at year end

exchange

rate

(1)

$

Adjustment

for hedged

debt and

finance costs

(1)(2)

$

Long-term

debt

repayable

at maturity

$

2010 2009

Corporate

Senior notes –

Cdn 6.50% due June 2, 2014 6.56 594,941 5,059 600,000 593,824 6,176 600,000

Cdn 5.70% due March 2,

2017 5.72 396,124 3,876 400,000 395,646 4,354 400,000

Cdn 6.10% due November 16,

2012 6.11 447,749 2,251 450,000 446,836 3,164 450,000

Cdn 6.15% due May 9, 2016 6.34 292,978 7,022 300,000 291,987 8,013 300,000

Cdn 5.65% due October 1,

2019 5.69 1,240,673 9,327 1,250,000 –– –

Cdn 6.75% due November 9,

2039 6.80 641,684 8,316 650,000 –– –

Cdn 7.50% due November 20,

2013 7.50 347,129 2,871 350,000 346,380 3,620 350,000

US $440,000 8.25% due

April 11, 2010

(2)

7.88 –– –481,198 161,422 642,620

US $225,000 7.25% due

April 6, 2011

(2)

7.68 –– –245,632 110,206 355,838

US $300,000 7.20% due

December 15, 2011

(2)

7.61 –– –327,512 149,338 476,850

3,961,278 38,722 4,000,000 3,129,015 446,293 3,575,308

Other subsidiaries and entities

Burrard Landing Lot 2 Holdings

Partnership 6.31 20,950 83 21,033 21,473 101 21,574

Total consolidated debt 3,982,228 38,805 4,021,033 3,150,488 446,394 3,596,882

Less current portion 557 19 576 481,739 161,422 643,161

3,981,671 38,786 4,020,457 2,668,749 284,972 2,953,721

(1) Long-term debt is presented net of unamortized discounts, finance costs and bond forward proceeds of $38,805

(August 31, 2009 – $27,761). Amortization for 2010 amounted to $5,312 (2009 – $4,466; 2008 – $3,822)

86

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]