Shaw 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(iii) Deferred IRU revenue

Prepayments received under indefeasible right to use (“IRU”) agreements are amortized on a

straight-line basis into income over the term of the agreement and are recognized in the

Consolidated Statements of Income and Retained Earnings (Deficit) as deferred IRU revenue

amortization.

Cash and cash equivalents

Cash and cash equivalents include money market instruments that are purchased three months or

less from maturity, and are presented net of outstanding cheques. When the amount of outstanding

cheques and the amount drawn under the Company’s operating facility (see note 9) are greater than

the amount of cash and cash equivalents, the net amount is presented as bank indebtedness.

Short-term securities

Short-term securities include money market instruments with terms ranging from three to twelve

months to maturity and are recorded at cost plus accrued interest.

Allowance for doubtful accounts

The Company maintains an allowance for doubtful accounts for the estimated losses resulting from

the inability of its customers to make required payments. In determining the allowance, the

Company considers factors such as the number of days the subscriber account is past due, whether

or not the customer continues to receive service, the Company’s past collection history and changes

in business circumstances.

Inventories

Inventories include subscriber equipment such as DCTs and DTH receivers, which are held pending

rental or sale at cost or at a subsidized price. When subscriber equipment is sold, the equipment

revenue and equipment costs are deferred and amortized over two years. When the subscriber

equipment is rented, it is transferred to property, plant and equipment and amortized over its useful

life. Inventories are determined on a first-in, first-out basis, and are stated at cost due to the

eventual capital nature as either an addition to property, plant and equipment or deferred

equipment costs.

74

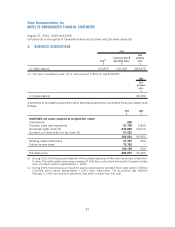

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]