Shaw 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEGMENTED OPERATIONS REVIEW

CABLE

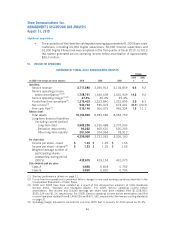

FINANCIAL HIGHLIGHTS

($000’s Cdn) 2010 2009

(3)

2008

(3)

2010

%

2009

%

Change

Service revenue (third party) 2,927,411 2,630,982 2,375,586 11.3 10.8

Service operating income before

amortization

(1)

1,456,827 1,271,279 1,155,967 14.6 10.0

Less:

Interest 213,898 209,438 199,600 2.1 4.9

Cash taxes on net income 136,000 23,300 – H100.0 100.0

Cash flow before the following: 1,106,929 1,038,541 956,367 6.6 8.6

Capital expenditures and equipment

costs (net) 757,085 694,084 648,336 9.1 7.1

Free cash flow before the following

Add back: 349,844 344,457 308,031 1.6 11.8

Non-cash stock-based

compensation 16,210 ––100.0 –

Free cash flow

(1)

366,054 344,457 308,031 6.3 11.8

Operating margin

(1)(2)

49.8% 48.3% 48.7% 1.5 (0.4)

(1) See key performance drivers on page 21.

(2) Operating margin adjusted to exclude the one-time CRTC Part II recovery for 2010 would be 48.1%.

(3) 2009 and 2008 have been restated as a result of the retrospective adoption of CICA Handbook

Section 3064, “Goodwill and Intangible Assets”. For 2009, Service operating income before

amortization and Free cash flow have been restated from $1,269,620, and $342,798, respectively.

For 2008, Service operating income before amortization and Free Cash flow have been restated from

$1,153,274 and $305,338, respectively. See new accounting standards on page 31.

2010 vs. 2009

OPERATING HIGHLIGHTS

kShaw’s Digital subscriber base continued to grow adding 328,841 new customers.

Penetration of Basic is now 70.7%, up from 56.7% at August 31, 2009.

kDigital Phone lines increased 234,402 during the year to 1,096,306 lines and Internet was

up 110,012 to total 1,818,347 as at August 31, 2010. Basic cable subscribers were up

2,410.

kDuring the year the Company completed the acquisition of Mountain Cablevision operating in

Hamilton, Ontario adding approximately 41,000 Basic cable customers, including 24,000

Digital subscribers, 30,000 Internet subscribers, and 32,000 Digital Phone lines.

Cable service revenue for the year improved 11.3% to $2.93 billion over the last year. Customer

growth, including acquisitions, and rate increases accounted for the improvement. Service

operating income before amortization of $1.46 billion increased 14.6%. The increase was mainly

due to the revenue driven improvements, partially offset by higher employee related and other costs

51

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010