Shaw 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Employee benefit plans

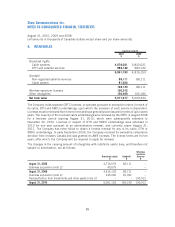

The Company accrues its obligations and related costs under its employee benefit plans. The cost of

pensions and other retirement benefits earned by certain senior employees is actuarially

determined using the projected benefit method pro-rated on service and management’s best

estimate of salary escalation and retirement ages of employees. Past service costs from plan

initiation and amendments are amortized on a straight-line basis over the estimated average

remaining service life (“EARSL”) of employees active at the date of recognition of past service

unless identification of a circumstance would suggest a shorter amortization period is appropriate.

Negative plan amendments which reduce costs are applied to reduce any existing unamortized past

service costs. The excess, if any, is amortized on a straight-line basis over EARSL. Actuarial gains or

losses occur because assumptions about benefit plans relate to a long time frame and differ from

actual experiences. These assumptions are revised based on actual experience of the plan such as

changes in discount rates, expected retirement ages and projected salary increases. Actuarial gains

(losses) are amortized on a straight-line basis over EARSL which for active employees covered by

the defined benefit pension plan is 10.9 years at August 31, 2010 (2009 – 11.1 years; 2008 –

12.1 years). When the restructuring of a benefit plan gives rise to both a curtailment and a

settlement of obligations, the curtailment is accounted for prior to the settlement.

August 31 is the measurement date for the Company’s employee benefit plans. Actuaries perform a

valuation annually to determine the actuarial present value of the accrued pension benefits. The

last actuarial valuation of the pension plan was performed August 31, 2010.

Stock-based compensation

The Company has a stock option plan for directors, officers, employees and consultants to the

Company. The options to purchase shares must be issued at not less than the fair value at the date of

grant. Any consideration paid on the exercise of stock options, together with any contributed surplus

recorded at the date the options vested, is credited to share capital.

The Company calculates the fair value of stock-based compensation awarded to employees using

the Black-Scholes Option Pricing Model. The fair value of options are expensed and credited to

contributed surplus over the vesting period of the options.

Earnings per share

Basic earnings per share is calculated using the weighted average number of Class A Shares and

Class B Non-Voting Shares outstanding during the year. The Company uses the treasury stock

method of calculating diluted earnings per share. This method assumes that any proceeds from the

exercise of stock options and other dilutive instruments would be used to purchase Class B Non-

Voting Shares at the average market price during the period.

Guarantees

The Company discloses information about certain types of guarantees that it has provided,

including certain types of indemnities, without regard to whether it will have to make any payments

under the guarantees (see note 16).

78

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]