Shaw 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

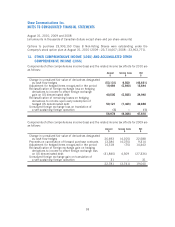

Cable

$

Wireless

$

DTH

$

Satellite Services

$

Total

$

Total

$

Satellite

2008

Service revenue – total 2,379,361 – 650,653 92,712 743,365 3,122,726

Intersegment (3,775) – (10,592) (3,500) (14,092) (17,867)

2,375,586 – 640,061 89,212 729,273 3,104,859

Service operating income before

amortization 1,155,967 – 206,541 48,421 254,962 1,410,929

Service operating income as % of external

revenue 48.7% – 32.3% 54.3% 35.0% 45.4%

Interest

(1)

199,600 – n/a n/a 29,599 229,199

Burrard Landing Lot 2 Holdings Partnership – 1,389

– 230,588

Cash taxes

(2)

––– – – –

Segment assets 6,460,141 190,912 869,710 523,736 1,393,446 8,044,499

Corporate assets 308,260

Total assets 8,352,759

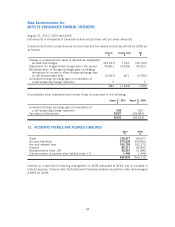

Capital expenditures and equipment costs (net)

by segment

Capital expenditures 602,848 – 2,997 (766) 2,231 605,079

Equipment costs (net) 45,488 – 75,839 – 75,839 121,327

648,336 – 78,836 (766) 78,070 726,406

Reconciliation to Consolidated Statements of

Cash Flows

Additions to property, plant and equipment 554,387

Additions to equipment costs (net) 121,327

Additions to other intangibles 51,706

Total of capital expenditures and equipment

costs (net) per Consolidated Statements of

Cash Flows 727,420

Increase in working capital related to capital

expenditures 2,608

Less: Satellite services equipment profit

(4)

(3,622)

Total capital expenditures and equipment

costs (net) reported by segments 726,406

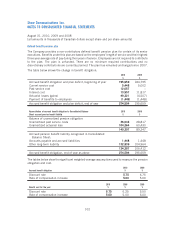

(1) The Company reports interest on a segmented basis for Cable, Wireless and combined satellite only. It

does not report interest on a segmented basis for DTH and Satellite Services. Interest is allocated to the

Wireless division based on the Company’s average cost of borrowing to fund the capital expenditures and

operating costs.

(2) The Company reports cash taxes on a segmented basis for Cable and combined satellite only. It does not

report cash taxes on a segmented basis for DTH and Satellite Services.

(3) The Company realized gains totaling $13,384 on cancellation of certain of its US dollar forward

purchase contracts in respect of capital expenditures and equipment costs. The gains were included in

other comprehensive income and reclassified to the initial carrying amount of capital assets or

equipment costs when the assets were recognized.

(4) The profit from the sale of satellite equipment is subtracted from the calculation of segmented capital

expenditures and equipment costs (net) as the Company views the profit on sale as a recovery of

expenditures on customer premise equipment.

99

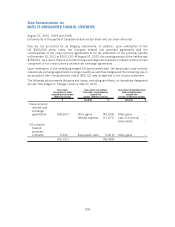

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]