Shaw 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

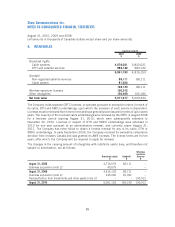

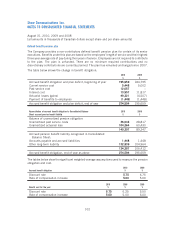

Contributed surplus

The changes in contributed surplus are as follows:

2010

$

2009

$

Balance, beginning of year 38,022 23,027

Stock-based compensation 17,838 16,974

Stock options exercised (2,530) (1,979)

Balance, end of year 53,330 38,022

As at August 31, 2010, the total unamortized compensation cost related to unvested options is

$32,453 and will be recognized over a weighted average period of approximately 2.9 years.

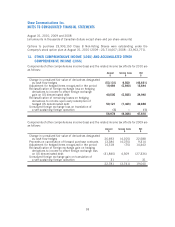

Dividends

To the extent that dividends are declared at the election of the board of directors, the holders of

Class B Non-Voting Shares are entitled to receive during each dividend period, in priority to the

payment of dividends on the Class A Shares, an additional dividend at a rate of $0.0025 per share

per annum. This additional dividend is subject to proportionate adjustment in the event of future

consolidations or subdivisions of shares and in the event of any issue of shares by way of stock

dividend. After payment or setting aside for payment of the additional non-cumulative dividends on

the Class B Non-Voting Shares, holders of Class A Shares and Class B Non-Voting Shares participate

equally, share for share, as to all subsequent dividends declared.

Share transfer restriction

The Articles of the Company empower the directors to refuse to issue or transfer any share of the

Company that would jeopardize or adversely affect the right of Shaw Communications Inc. or any

subsidiary to obtain, maintain, amend or renew a license to operate a broadcasting undertaking

pursuant to the Broadcasting Act (Canada).

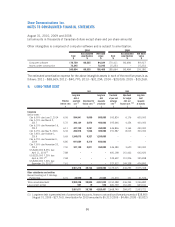

Earnings per share

Earnings per share calculations are as follows:

2010 2009 2008

Numerator for basic and diluted earnings per share($) 532,732 536,475 673,201

Denominator (thousands of shares)

Weighted average number of Class A Shares and Class B

Non-Voting Shares for basic earnings per share 432,675 429,153 431,070

Effect of potentially dilutive securities 1,207 1,628 2,797

Weighted average number of Class A Shares and Class B

Non-Voting Shares for diluted earnings per share 433,882 430,781 433,867

Earnings per share($)

Basic 1.23 1.25 1.56

Diluted 1.23 1.25 1.55

92

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]