Shaw 2010 Annual Report Download - page 27

Download and view the complete annual report

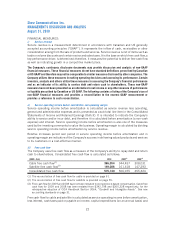

Please find page 27 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.equipment costs (net). All of the line items used in the free cash flow calculation are as reported on

a segmented basis in the Company’s Note 15 to the Consolidated Financial Statements. Segmented

service operating income before amortization, which is the starting point of the free cash flow

calculation, excludes the profit from satellite services equipment which is recognized as an

amortization line element in the income statement. As a result, equipment profit from satellite

services is subtracted from the calculation of segmented capital expenditures and equipment costs

(net).

Commencing in 2009, for the purposes of determining free cash flow, the Company revised its

calculation of capital expenditures (on an accrual basis) to net proceeds on capital dispositions.

Historically, the proceeds received on the sale of property, plant and equipment were not included in

the free cash flow calculation as they were generally nominal. These have become more significant

as the Company consolidates its operating groups at the new campus style facility in Calgary,

disposes of redundant assets, and replaces various operating assets as it continues to upgrade and

improve competitiveness.

Commencing in 2010, for purposes of determining free cash flow, the Company has excluded stock-

based compensation expense, reflecting the fact that it is not a reduction in the Company’s cash

flow. This practice is more in line with the Company’s North American peers who also report a

calculation of free cash flow.

STATISTICAL MEASURES:

Subscriber counts, including penetration and bundled customers

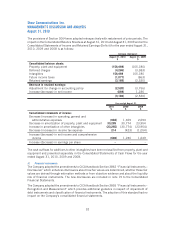

The Company measures the count of its customers in Cable and DTH (Shaw Direct). Basic cable

subscribers include residential customers, multiple dwelling units (“MDUs”) and commercial

customers. A residential subscriber who receives at a minimum, basic cable service, is counted as

one subscriber. In the case of MDUs, such as apartment buildings, each tenant with a minimum of

basic cable service is counted as one subscriber, regardless of whether invoiced individually or

having services included in his or her rent. Each building site of a commercial customer (e.g.,

hospitals, hotels or retail franchises) that is receiving at a minimum, basic cable service, is counted

as one subscriber. Digital customers include the count of Basic subscribers with one or more active

DCTs. Internet customers include all modems on billing plus pending installations and Digital

Phone lines includes all phone lines on billing plus scheduled installations due to the growth nature

of these products. All subscriber counts exclude complimentary accounts but include promotional

accounts.

Cable measures penetration for basic services as a percentage of homes passed and, in the case of

all other services, as a percentage of Basic customers.

Shaw Direct measures its count of subscribers in the same manner as Cable counts its Basic

customers, except that it also includes seasonal customers who have indicated their intention to

reconnect within 180 days of disconnection.

Subscriber counts and penetration statistics measure market share and also indicate the success of

bundling and pricing strategies.

G. Critical accounting policies and estimates

The Company prepared its Consolidated Financial Statements in accordance with Canadian GAAP.

An understanding of the Company’s accounting policies is necessary for a complete analysis of

results, financial position, liquidity and trends. Refer to Note 1 to the Consolidated Financial

23

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010