Shaw 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

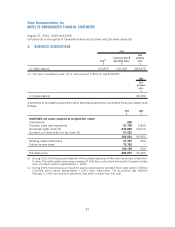

mortgage bonds in respect of the commercial component of the Shaw Tower. The bonds bear

interest at 6.31% compounded semi-annually and are collateralized by the property and the

commercial rental income from the building with no recourse to the Company.

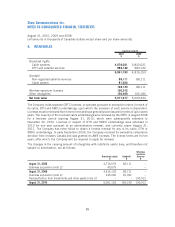

Debt retirement costs

In October 2009, the Company redeemed all of its outstanding US $440,000 8.25% senior notes

due April 11, 2010, US $225 million 7.25% senior notes due April 6, 2011 and US $300 million

7.20% senior notes due December 15, 2011. The Company incurred costs of $79,488 and wrote-

off the remaining unamortized discount and finance costs of $2,097. In connection with the early

redemption of the US senior notes, the Company settled portions of the principal component of the

associated cross-currency interest rate swaps and entered into offsetting or amended agreements

with the counterparties for the remaining end of swap notional principal exchanges (see note 19).

On April 15, 2009 the Company redeemed the Videon Cablesystems Inc. $130,000 Senior

Debentures. In connection with the early redemption, the Company incurred costs of $9,161

and wrote-off the remaining unamortized fair value adjustment of $906.

On January 30, 2008, the Company redeemed its $100,000 8.54% Canadian Originated Preferred

Securities. In connection with this early redemption, the Company incurred costs of $4,272 and

wrote-off the remaining unamortized financing charges of $992.

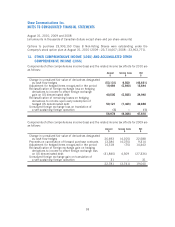

Debt covenants

The Company and its subsidiaries have undertaken to maintain certain covenants in respect of the

credit agreements and trust indentures described above. The Company and its subsidiaries were in

compliance with these covenants at August 31, 2010.

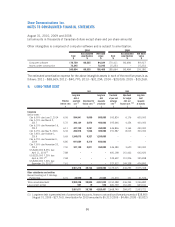

Long-term debt repayments

Mandatory principal repayments on all long-term debt in each of the next five years and thereafter

are as follows:

$

2011 576

2012 613

2013 450,652

2014 950,694

2015 738

Thereafter 2,617,760

4,021,033

88

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]