Shaw 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

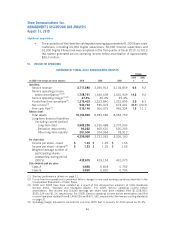

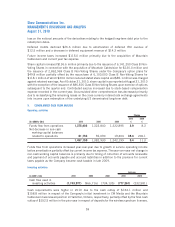

Other income and expenses

(In $000’s Cdn) 2010 2009 2008 2010 2009

Decrease in income

Debt retirement costs (81,585) (8,255) (5,264) (73,330) (2,991)

Loss on financial instruments (47,306) – – (47,306) –

Other gains 5,513 19,644 24,009 (14,131) (4,365)

During 2010, the Company redeemed all of its outstanding US $440 million 8.25% senior notes

due April 11, 2010, US $225 million 7.25% senior notes due April 6, 2011 and US $300 million

7.20% senior notes due December 15, 2011. In connection with the early redemption, the

Company incurred costs of $79.5 million and wrote-off the remaining discount and finance costs

of $2.1 million. The Company used proceeds from its $1.25 billion senior notes issuance in early

October 2009 to fund the cash requirements for the redemptions. The refinancing of the three

series of US senior notes has reduced the Company’s annual interest expense by approximately

$35.0 million.

During 2009, the Company redeemed the Videon CableSystems Inc. $130 million senior

debentures. In connection with the early redemption, the Company incurred costs of $9.2 million

and wrote-off the remaining unamortized fair value adjustment of $0.9 million. The Company used

part of the proceeds from its $600 million senior notes issuance completed in March 2009 to fund

the redemption.

Debt retirement costs in 2008 arose on the redemption of Canadian Originated Preferred Securities

(“COPrS”). In connection with the early redemption of the $100 million COPrS, the Company

incurred costs of $4.3 million and wrote-off the remaining unamortized financing charges of

$1.0 million.

On redemption of the US senior notes in October 2009, the Corporation unwound and settled a

portion of the principal components of two of the associated cross-currency agreements and entered

into offsetting currency swap transactions and amended agreements for the outstanding notional

principal amounts. The associated interest component of the cross-currency interest rate exchange

agreements remains outstanding. As these contracts no longer qualify as cash flow hedges, the

related loss in accumulated other comprehensive loss of $50.1 million was reclassified to net

income. Subsequent changes in the value of these agreements is recorded in net income. The total

amount recorded for the year ended August 31, 2010 was a loss of $47.3 million.

Other gains decreased in 2010 and 2009 due to a gain of $10.8 million on cancellation of a bond

forward contract and amounts realized on disposal of property, plant and equipment in 2009 and

the net customs duty recovery of $22.3 million recorded in 2008.

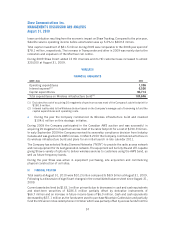

Equity loss on investee

During the year, the Company recorded a loss of $11.3 million for its 49.9% equity interest in CW

Media acquired on May 3, 2010. The loss was comprised of approximately $20.8 million of service

operating income before amortization offset by interest expense of $9.9 million and other costs of

$22.2 million. Other costs include the net impact of $17.6 million with respect to foreign exchange

losses on US denominated long-term debt and fair value adjustments on derivative instruments.

Income tax expense

The income tax expense was calculated using current statutory income tax rates of 29.3% for 2010,

30.2% for 2009 and 32.0% for 2008 and was adjusted for the reconciling items identified in

49

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010