Shaw 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SATELLITE (DTH and Satellite Services)

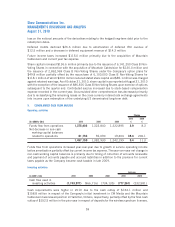

2010 vs. 2009

OPERATING HIGHLIGHTS

kDuring the year Shaw Direct added 4,855 customers and as at August 31, 2010 DTH

customers total 905,796.

kFree cash flow of $149.1 million for 2010 compares to $161.6 million in 2009.

kIn March 2010 Shaw Direct entered into agreements with Telesat to acquire capacity on a new

satellite expected to be available in late 2012.

Service revenue of $790.2 million for 2010 was up 4.0% over last year. The improvement was

primarily due to rate increases and customer growth the total of which was partially offset by lower

revenues in the Satellite services division related to various contract renegotiations.

Service operating income before amortization improved 12.6% over the comparable period to

$303.3 million. The improvement was due to revenue related growth partially offset by LPIF costs.

The current period included a one-time Part II fee recovery of $26.6 million. Excluding the recovery,

the annual improvement was 2.8%.

Total capital investment of $85.6 million increased over the prior year spend of $81.5 million.

Success based capital was higher mainly due to increased activations as well as lower customer

pricing.

Shaw Direct continually strives to deliver an exceptional customer experience through leading

technology, innovative programming and high quality customer service. During the current year

Shaw Direct introduced a new HD PVR with advanced features and launched a number of HD

channels including CNN HD and Global Toronto HD. Shaw Direct now offers 65 HD channels to its

395,000 HD customers.

During the current year Shaw Direct entered into agreements with Telesat to acquire capacity on a

new satellite expected to be available in late 2012. The new satellite will increase Shaw Direct’s

satellite television services by 30 percent through 16 new national transponders. The transponders

residing on the third satellite will provide bandwidth for expanded customer choice, including new

high definition and other advanced services. It will also provide enhanced service quality acting as

important in-orbit back-up capacity.

2009 vs. 2008

OPERATING HIGHLIGHTS

kFree cash flow of $161.6 million for 2009 compares to $147.3 million in the prior year.

kDuring the year Shaw Direct added 8,413 customers and as at August 31, 2009 customers

total 900,941.

Service revenue of $759.9 million in 2009 was up 4.2% over 2008. The improvement was primarily

due to rate increases and customer growth. Service operating income before amortization for the DTH

segment was up 8.2% to $223.5 million. The increase was mainly due to the revenue related

improvement partially offset by costs to support customer service and other costs related to growth. In

the Satellite services segment service operating income before amortization was down 5.3% due to

56

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010