Shaw 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

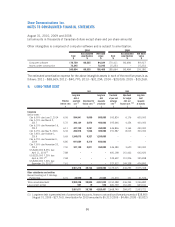

The income tax expense or recovery differs from the amount computed by applying Canadian

statutory rates to income before income taxes for the following reasons:

2010

$

2009

$

2008

$

Current statutory income tax rate 29.3% 30.2% 32.0%

Income tax expense at current statutory rates 213,046 219,787 220,904

Increase (decrease) in taxes resulting from:

Non-taxable portion of foreign exchange gains or

losses and amounts on sale/write-down of assets

and investments (1,221) (551) –

Decrease in valuation allowance (11,036) (3,463) (9,867)

Effect of future tax rate reductions (17,643) (22,582) (187,990)

Originating temporary differences recorded at future

tax rates expected to be in effect when realized (11,178) (9,753) (11,601)

Other 11,169 7,759 5,974

Income tax expense 183,137 191,197 17,420

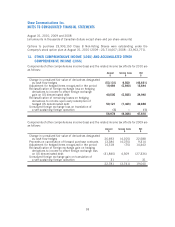

Significant components of income tax expense (recovery) are as follows:

2010

$

2009

$

2008

$

Current income tax expense 167,767 23,300 –

Future income tax expense related to origination and

reversal of temporary differences 44,049 193,942 215,277

Future income tax recovery resulting from rate changes

and valuation allowance (28,679) (26,045) (197,857)

Income tax expense 183,137 191,197 17,420

96

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]