Shaw 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

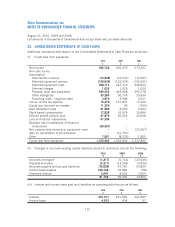

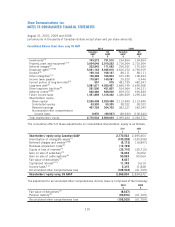

20. CONSOLIDATED STATEMENTS OF CASH FLOWS

Additional disclosures with respect to the Consolidated Statements of Cash Flows are as follows:

(i) Funds flow from operations

2010

$

2009

$

2008

$

Net income 532,732 536,475 673,201

Non-cash items:

Amortization –

Deferred IRU revenue (12,546) (12,547) (12,547)

Deferred equipment revenue (120,639) (132,974) (126,601)

Deferred equipment costs 228,714 247,110 228,524

Deferred charges 1,025 1,025 1,025

Property, plant and equipment 526,432 449,808 390,778

Other intangibles 33,285 30,774 23,954

Financing costs – long-term debt 3,972 3,984 3,627

Future income tax expense 15,370 167,897 17,420

Equity loss (income) on investee 11,250 99 (295)

Debt retirement costs 81,585 8,255 5,264

Stock-based compensation 17,838 16,974 16,894

Defined benefit pension plan 27,875 26,052 22,068

Loss on financial instruments 47,306 ––

Realized loss on settlement of financial

instruments (26,357) ––

Net customs duty recovery on equipment costs –– (22,267)

Gain on cancellation of bond forward –(10,757) –

Other 7,561 (8,335) 1,850

Funds flow from operations 1,375,403 1,323,840 1,222,895

(ii) Changes in non-cash working capital balances related to operations include the following:

2010

$

2009

$

2008

$

Accounts receivable (1,217) (5,714) (32,646)

Prepaids and other (2,211) (14,393) (9,900)

Accounts payable and accrued liabilities (76,608) 47,781 54,839

Income taxes payable 156,748 22,894 (58)

Unearned revenue 5,044 8,522 7,069

81,756 59,090 19,304

(iii) Interest and income taxes paid and classified as operating activities are as follows:

2010

$

2009

$

2008

$

Interest 237,377 231,594 241,899

Income taxes 4,243 404 57

112

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]