Shaw 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the broadcast rights for each reporting unit or wireless assets as at March 1, 2010 would not result

in any impairment loss. Further, any changes in economic conditions since the impairment testing

conducted as at March 1, 2010 do not represent events or changes in circumstance that would be

indicative of impairment at August 31, 2010.

Significant estimates inherent to this analysis include discount rates and the terminal value. At

March 1, 2010, the estimates that have been utilized in the impairment tests reflect any changes in

market conditions and are as follows:

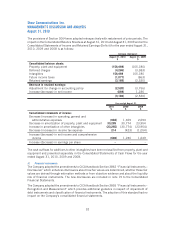

Discount Rate Terminal Growth Rate

Terminal Service

Operating Income

before Amortization

Multiple

Terminal Value

Cable systems 9.0% 2.0% 5.5x

DTH and satellite services 11.0% 1.5% 5.0x

Wireless assets 12.0% 2.0% 5.5x

A sensitivity analysis of significant estimates is conducted as part of every impairment test. With

respect to the impairment tests performed in the third quarter, in the Cable reporting unit an

increase in the discount rate of 1% would cause the fair value to decline by less than 13%, a 1%

decrease in the terminal growth rate would cause the fair value to decline by less than 10%, and a

0.5 times reduction in the terminal service operating income before amortization multiple would

cause the fair value to decline by less than 7%. With respect to the DTH and Satellite services

reporting unit, an increase in the discount rate of 1% would cause the fair value to decline by less

than 10%, a 1% decrease in the terminal growth rate would cause the fair value to decline by less

than 7%, and a 0.5 times reduction in the terminal service operating income before amortization

multiple would cause the fair value to decline by less than 7%. With respect to wireless assets, an

increase in the discount rate of 1% would cause the fair value to decline by less than 35%, a 1%

decrease in the terminal growth rate would cause the fair value to decline by less than 19%, and a

0.5 times reduction in the terminal service operating income before amortization multiple would

cause the fair value to decline by less than 16%.

2010

$

2009

$

Carrying amount

Broadcast rights

Cable systems 4,078,021 3,833,021

DTH and satellite services 983,132 983,132

5,061,153 4,816,153

Goodwill

Non-regulated satellite services 88,111 88,111

Cable system 81,032 –

169,143 88,111

Wireless spectrum licenses 190,912 –

Net book value 5,421,208 4,904,264

viii) Employment benefit plans

Shaw has a defined benefit pension plan for key senior executives. The amounts reported in the

financial statements relating to the defined benefit pension plan are determined using actuarial

valuations that are based on several assumptions. The valuation uses management’s assumptions

29

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010