Shaw 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

determinable. Management expects to complete this assessment in time for parallel recording of

financial information in accordance with IFRS beginning September 1, 2010.

The Company continues to monitor and assess the impact of evolving differences between Canadian

GAAP and IFRS, since the IASB is expected to continue to issue new accounting standards during

the transition period. As a result, the final impact of IFRS on the Company’s consolidated financial

statements can only be measured once all the applicable IFRS at the conversion date are known.

Differences with respect to recognition, measurement, presentation and disclosure of financial

information are expected to be in the following key accounting areas:

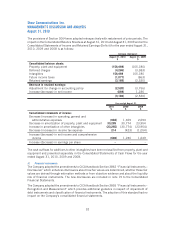

Key accounting area Differences from Canadian GAAP, with

potential impact for the Company

Presentation of Financial Statements

(IAS 1)

IAS 1 requires additional disclosures in the

notes to financial statements.

Share-based Payments (IFRS 2) IFRS 2 requires cash-settled awards to

employees be measured at fair value at

the initial grant date and re-measured at

fair value at the end of each reporting

period.

IFRS 2 also requires the fair value of stock-

based compensation awards to be

recognized using a graded vesting method

based on the vesting period of the options.

Business Combinations (IFRS 3R) IFRS 3R requires acquisition-related and

restructuring costs to be expensed as

incurred and contingent consideration

recorded at its fair value on acquisition

date; subsequent changes in fair value of

contingent consideration classified as a

liability is recognized in earnings.

Income Taxes (IAS 12) IAS 12 recognition and measurement

criteria for deferred tax assets and

liabilities may differ.

Employee Benefits (IAS 19) IAS 19 requires past service costs of

defined benefit plans to be expensed on

an accelerated basis, with vested past

service costs immediately expensed and

unvested past service costs amortized on

a straight line basis until benefits become

vested.

IAS 19 has an accounting policy choice that

allows the Company to recognize actuarial

gains and losses using one of the following

methods:

• in net income using the corridor

approach amortized over the expected

average remaining working lives,

35

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010