Shaw 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

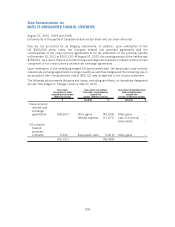

Consolidated Balance Sheet items using US GAAP

Canadian

GAAP

$

US

GAAP

$

Canadian

GAAP

$

US

GAAP

$

2010 2009

Investments

(3)

743,273 731,510 194,854 194,854

Property, plant and equipment

(10)

3,004,649 3,010,222 2,716,364 2,720,564

Deferred charges

(2)

232,843 171,093 256,355 170,260

Broadcast rights

(1)(5)(6)

5,061,153 5,035,919 4,816,153 4,790,919

Goodwill

(3)

169,143 168,167 88,111 88,111

Other intangibles

(10)

156,469 166,804 105,180 108,693

Income taxes payable 170,581 149,081 25,320 5,446

Current portion of long-term debt

(2)

557 576 481,739 482,341

Long-term debt

(2)

3,981,671 4,020,457 2,668,749 2,695,908

Other long-term liabilities

(9)

291,500 431,807 104,964 194,211

Deferred credits

(2)(8)

632,482 629,000 659,073 656,830

Future income taxes 1,451,859 1,415,442 1,336,859 1,299,244

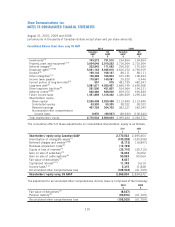

Shareholders’ equity:

Share capital 2,250,498 2,250,498 2,113,849 2,113,849

Contributed surplus 53,330 53,330 38,022 38,022

Retained earnings 457,728 364,703 382,227 283,044

Accumulated other comprehensive

income (loss) 8,976 (99,527) (38,634) (100,343)

Total shareholders’ equity 2,770,532 2,569,004 2,495,464 2,334,572

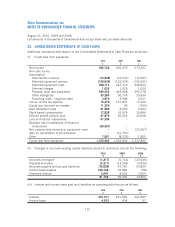

The cumulative effect of these adjustments on consolidated shareholders’ equity is as follows:

2010

$

2009

$

Shareholders’ equity using Canadian GAAP 2,770,532 2,495,464

Amortization of intangible assets

(1)

(130,208) (130,208)

Deferred charges and credits

(2)(8)

(6,173) (16,847)

Business acquisition costs

(3)

(12,739) –

Equity in loss of investee

(4)

(35,710) (35,710)

Gain on sale of subsidiary

(5)

16,052 16,052

Gain on sale of cable systems

(6)

50,063 50,063

Fair value of derivatives

(7)

8,627 –

Capitalized interest

(10)

11,748 5,619

Income taxes

(11)

5,315 11,848

Accumulated other comprehensive loss (108,503) (61,709)

Shareholders’ equity using US GAAP 2,569,004 2,334,572

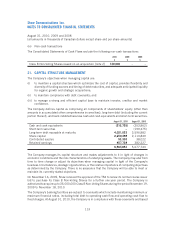

The adjustment to accumulated other comprehensive income (loss) is comprised of the following:

2010

$

2009

$

Fair value of derivatives

(7)

(8,627) –

Pension liability

(9)

(99,876) (61,709)

Accumulated other comprehensive loss (108,503) (61,709)

115

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]