Shaw 2010 Annual Report Download - page 65

Download and view the complete annual report

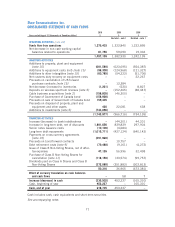

Please find page 65 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pursuant to this shelf prospectus, the Company completed three senior note offerings totaling

$2.5 billion as follows:

kOn March 27, 2009, Shaw issued $600 million of senior notes at a rate of 6.50% due June 2,

2014. Net proceeds (after issue and underwriting expenses) of $593.6 million were used for

debt repayment, working capital and general corporate purposes. Excess funds were held in

cash and short-term securities.

kOn October 1, 2009, the Company issued $1.25 billion of senior notes at a rate of 5.65% due

2019. Net proceeds (after issuance at a discount of $4.0 million and, issue and underwriting

expenses) of $1.24 billion were used to fund the majority of the cash requirements, including

the make-whole premiums and payments in respect of the associated cross-currency interest

rate agreements relating to the early redemption of the US $440 million 8.25% senior notes

due April 11, 2010, US $225 million 7.25% senior notes due April 6, 2011 and

US $300 million 7.20% senior notes due December 15, 2011.

kOn November 9, 2009, the Company issued $650 million of senior notes at a rate of 6.75%

due 2039. Net proceeds (after issuance at a discount of $4.4 million and issue and

underwriting expenses) of $641.6 million were used for working capital and general corporate

purposes.

On November 16, 2009, Shaw received the approval of the TSX to renew its normal course issuer

bid to purchase its Class B Non-Voting Shares for a further one year period. The Company is

authorized to acquire up to 35,000,000 Class B Non-Voting Shares during the period November 19,

2009 to November 18, 2010 representing approximately 10% of the public float of Class B Non-

Voting Shares. During the year, the Company repurchased 6,100,000 of its Class B Non-Voting

Shares for cancellation for $118.1 million.

On November 12, 2008, Shaw received the approval of the TSX to renew its normal course issuer

bid to purchase its Class B Non-Voting Shares for a one year period. The Company was authorized to

acquire up to 35,000,000 Class B Non-Voting Shares during the period November 19, 2008 to

November 18, 2009. During the first quarter of 2009, the Company repurchased 1,683,000

Class B Non-Voting Shares for $33.6 million under the previous normal course issuer bid which

expired on November 18, 2008.

At August 31, 2010, Shaw held $216.7 million in cash and cash equivalents and had access to

$1 billion of available credit facilities. Subsequent to August 31, 2010 the Company put in place

an additional unsecured $500 million revolving credit facility to provide additional liquidity. Based

on cash balances, available credit facilities and forecasted free cash flow, the Company expects to

have sufficient liquidity to fund operations and obligations during the upcoming fiscal year. On a

longer-term basis, Shaw expects to generate free cash flow and have borrowing capacity sufficient

to finance foreseeable future business plans and refinance maturing debt.

Debt structure

Shaw structures its borrowings generally on a stand-alone basis. The borrowings of Shaw are

unsecured. There are no restrictions that prevent the subsidiaries of the Company from transferring

funds to Shaw.

Shaw’s borrowings are subject to covenants which include maintaining minimum or maximum

financial ratios. At August 31, 2010, Shaw is in compliance with these covenants and based on

current business plans, the Company is not aware of any condition or event that would give rise to

non-compliance with the covenants over the life of the borrowings.

61

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010