Shaw 2010 Annual Report Download - page 80

Download and view the complete annual report

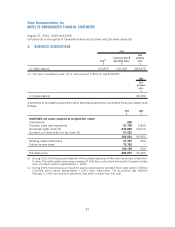

Please find page 80 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other intangibles include computer software that is not an integral part of the related hardware.

Other intangibles are amortized on a straight-line basis over estimated useful lives ranging from four

to ten years. The Company reviews the estimates of lives and useful lives on a regular basis and

reviews other intangibles for impairment whenever events or changes in circumstances indicate

that the carrying value may not be recoverable. An impairment is recognized when the carrying

amount of an asset is greater than the future undiscounted net cash flows expected to be generated

by the asset. The impairment is measured as the difference between the carrying value of the asset

and its fair value calculated using quoted market prices or discounted cash flows.

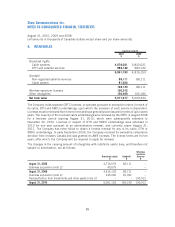

Deferred credits

Deferred credits primarily include: (i) prepayments received under IRU agreements amortized on a

straight-line basis into income over the term of the agreement; (ii) equipment revenue, as described

in the revenue and expenses accounting policy, deferred and amortized over two years to five years;

(iii) connection fee revenue and upfront installation revenue, as described in the revenue and

expenses accounting policy, deferred and amortized over two to ten years; and (iv) a deposit on a

future fibre sale.

Income taxes

The Company accounts for income taxes using the liability method, whereby future income tax

assets and liabilities are determined based on differences between the financial reporting and tax

bases of assets and liabilities measured using substantively enacted tax rates and laws that will be

in effect when the differences are expected to reverse. Income tax expense for the period is the tax

payable for the period and any change during the period in future income tax assets and liabilities.

Foreign currency translation

The financial statements of a foreign subsidiary, which is self-sustaining, are translated using the

current rate method, whereby assets and liabilities are translated at year-end exchange rates and

revenues and expenses are translated at average exchange rates for the year. Adjustments arising

from the translation of the financial statements are included in Other Comprehensive Income

(Loss).

Transactions originating in foreign currencies are translated into Canadian dollars at the exchange

rate at the date of the transaction. Monetary assets and liabilities are translated at the year-end rate

of exchange and non-monetary items are translated at historic exchange rates. The net foreign

exchange gain (loss) recognized on the translation and settlement of current monetary assets and

liabilities was $5,563 (2009 – ($1,599); 2008 – ($644)) and is included in other gains.

Exchange gains and losses on translating hedged long-term debt are included in the Company’s

Consolidated Statements of Income and Retained Earnings (Deficit). Foreign exchange gains and

losses on hedging derivatives are reclassified from Other Comprehensive Income (Loss) to income

to offset the foreign exchange adjustments on hedged long-term debt.

Financial instruments other than derivatives

Financial instruments have been classified as loans and receivables, assets available-for-sale,

assets held-for-trading or financial liabilities. Cash and cash equivalents and short-term securities

76

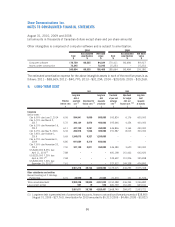

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]