Shaw 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

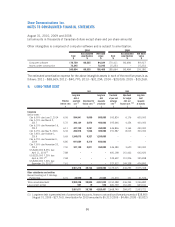

ownership compliance decision from Industry Canada and was granted its AWS licenses.

Accordingly, the deposits on spectrum licenses were reclassified to Intangible assets.

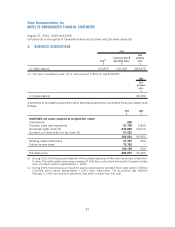

CW Media

On May 3, 2010 the Company announced that it had entered into agreements to acquire 100% of

the broadcasting business of Canwest Global Communications Corp. (“Canwest”) including

CW Investments Co. (“CW Media”), the company that owns the specialty channels acquired from

Alliance Atlantis Communications Inc. in 2007. The total consideration, including assumed debt,

is approximately $2,000,000.

During the current year, the Company completed certain portions of the acquisition including

acquiring a 49.9% equity interest, a 29.9% voting interest, and an option to acquire an additional

14.8% equity interest and 3.4% voting interest in CW Media for total consideration of $750,375,

including acquisition costs.

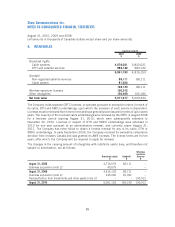

The Company exercises significant influence over CW Media with its 49.9% ownership and

recorded an equity loss of $11,250 for the period of May 3 to August 31, 2010. The difference

between the cost of the 49.9% equity investment in CW Media and the Company’s share of the

underlying net book value of CW Media’s net assets on May 3, 2010 was $159,000 which was

allocated on a preliminary basis as follows:

$

Indefinite life broadcast rights 181,000

Goodwill, not deductible for tax 47,000

228,000

Long-term debt (23,000)

Future income taxes (46,000)

159,000

83

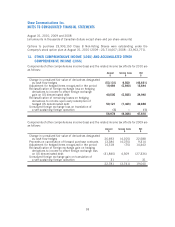

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]