Shaw 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

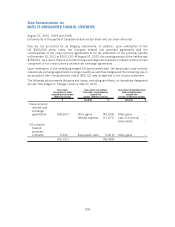

they are not accounted for as hedging instruments. In addition, upon redemption of the

US $300,000 senior notes, the Company entered into amended agreements with the

counterparties of the cross-currency agreements to fix the settlement of the principal liability

on December 15, 2011 at $162,150. At August 31, 2010, the carrying amount of the liability was

$158,661. As a result, there is no further foreign exchange rate exposure in respect of the principal

component of the cross-currency interest rate exchange agreements.

Upon redemption of the underlying hedged US denominated debt, the associated cross-currency

interest rate exchange agreements no longer qualify as cash flow hedges and the remaining loss in

accumulated other comprehensive loss of $50,121 was reclassified to the income statement.

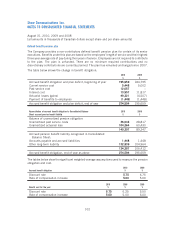

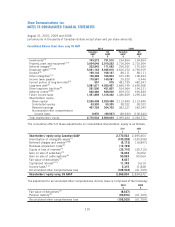

The following table presents the gains and losses, excluding tax effects, on derivatives designated

as cash flow hedges to manage currency risks for 2010.

$ Location $ Location $

Gain (loss)

recognized in other

comprehensive income

(effective portion)

Gain (loss) reclassified

from other comprehensive

income into

income (effective portion)

Gain (loss) reclassified from

other comprehensive

income into

income (ineffective portion)

Cross-currency

interest rate

exchange

agreements (58,657) Other gains (40,505) Other gains –

Interest expense (11,671) Loss on financial

instruments –

US currency

forward

purchase

contracts 5,526 Equipment costs (7,813) Other gains –

(53,131) (59,989) –

108

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2010, 2009 and 2008

[all amounts in thousands of Canadian dollars except share and per share amounts]