Shaw 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for the discount rate, rate of compensation increase, and expected average remaining years of

service of employees. While the Company believes these assumptions are reasonable, differences in

actual results or changes in assumptions could affect employee benefit obligations and the related

income statement impact. The Company accounts for differences between actual and assumed

results by recognizing differences in benefit obligations and plan performance over the working

lives of the employees who benefit from the plan. The most significant assumption used to calculate

the net employee benefit plan expense is the discount rate. The discount rate is the interest rate

used to determine the present value of the future cash flows that is expected will be needed to settle

employee benefit obligations. It is usually based on the yield on long-term, high-quality corporate

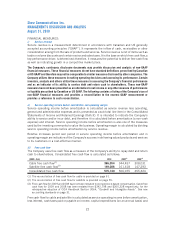

fixed income investments and is determined at the end of every year. The following table illustrates

the increase on the accrued benefit obligation and pension expense of a 1% decrease in the

discount rate:

Accrued Benefit

Obligation at

End of Fiscal 2010

Pension Expense

Fiscal 2010

Discount Rate 5.75% 6.75%

Impact of: 1% decrease ($000’s Cdn) 56,480 4,950

ix) Future income taxes

The Company has recognized future income tax assets in respect of its losses and losses of certain of

its subsidiaries. Realization of future income tax assets is dependent upon generating sufficient

taxable income during the period in which the temporary differences are deductible. The Company

has evaluated the likelihood of realization of future income tax assets based on forecasts of taxable

income of future years and based on the ability to reorganize its corporate structure to accommodate

use of tax losses in future years. Assumptions used in these taxable income forecasts are consistent

with internal forecasts and are compared for reasonability to forecasts prepared by external

analysts. Significant changes in assumptions with respect to internal forecasts or the inability

to implement tax planning strategies could result in future impairment of these assets.

x) Commitments and contingencies

The Company is subject to various claims and contingencies related to lawsuits, taxes and

commitments under contractual and other commercial obligations. Contingent losses are

recognized by a charge to income when it is likely that a future event will confirm that an asset

has been impaired or a liability incurred at the date of the financial statements and the amount can

be reasonably estimated. Contractual and other commercial obligations primarily relate to network

fees and operating lease agreements for use of transmission facilities, including maintenance of

satellite transponders and lease of premises in the normal course of business. Significant changes

in assumptions as to the likelihood and estimates of the amount of a loss could result in recognition

of additional liabilities.

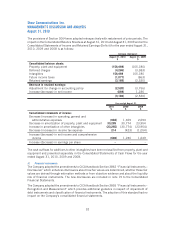

H. Related party transactions

Related party transactions are reviewed by Shaw’s Corporate Governance and Nominating

Committee, comprised of independent directors. The following sets forth certain transactions in

which the Company is involved.

Normal course transactions

The Company has entered into certain transactions and agreements in the normal course of

business with certain of its related parties.

30

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2010